Everyone's situation is unique. The advice my tax guy gave me, was to only record a single tax event when selling the mined coins (for cash or another coin) and then do it with a $0 cost basis as opposed to record a tax event when receiving the coins from the pool and then again when selling the mined coin, using costs basis of what the coin was worth at the time it was mined.Does that site calculate taxes? Mining means you should be adding the coins gain acquired to your adjusted gross income, per the IRS, and on sale of the coins, that's a 2nd tax event.

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Nvidia Purposely Reducing Hash Rate for RTX 3060 GPUs, Creates Cryptocurrency Mining Processors (CMP)

sfsuphysics

[H]F Junkie

- Joined

- Jan 14, 2007

- Messages

- 16,037

Reminds me of when Barry Bonds was about to break the home run record, and Congress (yes that Congress) actually had to talk about the potential tax implications of the person who caught the ball, what if some kid got it, what if ...etc. Bottom line is they were saying that there is inherent value to it regardless if it was sold or not, which to me always seemed like a way for the rich to simply keep all the cool shit in life as the average joe couldn't pay the tax liability on it, have to auction it in order to do so, and only someone with the money to buy it to actually keep it. I mean it became a non issue because it was hit in a location that fans couldn't get to, but still the fact that they put value on something that really only has value if you sell it was shocking.Everyone's situation is unique. The advice my tax guy gave me, was to only record a single tax event when selling the mined coins (for cash or another coin) and then do it with a $0 cost basis as opposed to record a tax event when receiving the coins from the pool and then again when selling the mined coin, using costs basis of what the coin was worth at the time it was mined.

D

Deleted member 162929

Guest

Reminds me of when Barry Bonds was about to break the home run record, and Congress (yes that Congress) actually had to talk about the potential tax implications of the person who caught the ball, what if some kid got it, what if ...etc. Bottom line is they were saying that there is inherent value to it regardless if it was sold or not, which to me always seemed like a way for the rich to simply keep all the cool shit in life as the average joe couldn't pay the tax liability on it, have to auction it in order to do so, and only someone with the money to buy it to actually keep it. I mean it became a non issue because it was hit in a location that fans couldn't get to, but still the fact that they put value on something that really only has value if you sell it was shocking.

That's why with direct eye contact

Your tax liability was created the moment you gained possession of it; destroying it afterwards doesn't remove it.That's why with direct eye contactyou destroy itslipped through your fingers into this ill-placed wood chipper, act of God

This isn't like when they come to confiscate your guns, but you tell them your entire collection was lost in a tragic boating accident last year.

If you are in the U.S., I would get a new tax guy as the rules are quite clear on how to treat mined coins--income when received (don't forget to offset electricity) which becomes your cost basis for capital gains/losses when you go to cash/stablecoins/alts. Depending on structure and size of operation, you could also expense equipment.Everyone's situation is unique. The advice my tax guy gave me, was to only record a single tax event when selling the mined coins (for cash or another coin) and then do it with a $0 cost basis as opposed to record a tax event when receiving the coins from the pool and then again when selling the mined coin, using costs basis of what the coin was worth at the time it was mined.

If you're operating as self-employed and file a Schedule C, I agree. That is pretty clear from Q/A #9 from IRS Notice 2014-21 here:If you are in the U.S., I would get a new tax guy as the rules are quite clear on how to treat mined coins--income when received (don't forget to offset electricity) which becomes your cost basis for capital gains/losses when you go to cash/stablecoins/alts. Depending on structure and size of operation, you could also expense equipment.

https://www.irs.gov/pub/irs-drop/n-14-21.pdf

On the other hand, if you're mining as a "hobby" and don't do a Schedule C (which of course means you can't subtract power cost or take a 179 on any equipment purchased in a given tax year), things are less clear.

YeuEmMaiMai

Extremely [H]

- Joined

- Jun 11, 2004

- Messages

- 34,510

something about a pooch and it was harmed. did you expect anything different? it's all about the Bengamins

something about a pooch and it was harmed. did you expect anything different? it's all about the Bengamins

Benjamins

GoldenTiger

Fully [H]

- Joined

- Dec 2, 2004

- Messages

- 30,009

That's not the current benjamin though!Benjamins View attachment 334453

DooKey

[H]F Junkie

- Joined

- Apr 25, 2001

- Messages

- 13,587

NightReaver

2[H]4U

- Joined

- Apr 20, 2017

- Messages

- 3,927

Literally already a thread on that, already proven to be fake news.

https://hardforum.com/threads/debun...-hash-rate-limiter-fake-news-read-op.2008497/

kirbyrj

Fully [H]

- Joined

- Feb 1, 2005

- Messages

- 30,729

Everyone's situation is unique. The advice my tax guy gave me, was to only record a single tax event when selling the mined coins (for cash or another coin) and then do it with a $0 cost basis as opposed to record a tax event when receiving the coins from the pool and then again when selling the mined coin, using costs basis of what the coin was worth at the time it was mined.

That is foolish. If you mine $10,000 worth of BTC at a cost basis of $0, and then sell it for $10,000 you owe taxes on $10,000 worth of capital gains. If you mine $10,000, claim it as income, and then sell it for $10,000 then you owe $0 in capital gains and you can write off your equipment, electricity, etc. against the $10,000 of income. And you don't think if you get audited a cost basis of $0 isn't going to be a red flag?

You should find a new tax guy.

Archaea

[H]F Junkie

- Joined

- Oct 19, 2004

- Messages

- 11,837

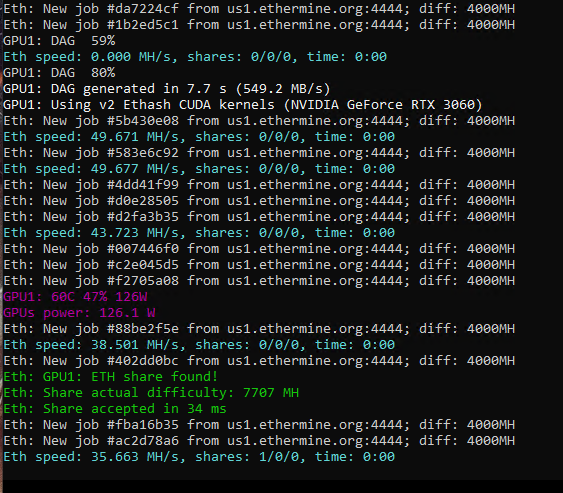

Multiple sites claiming that’s Octopus, not Daggerhashimoto. So not ETH. Until a full screenshot is provided it’s probably fake.

Archaea

[H]F Junkie

- Joined

- Oct 19, 2004

- Messages

- 11,837

If you mine with claimed expenses you have to pay income tax, and self employment tax, social security tax etc. If he does it the way he’s doing it, then all he is paying is electricity, but no tax until he cashed out. I do think “hobby mining” fits for some. That’s how I’m doing it. Except I am paying income tax on it and declaring it so that I can only pay long term capital gains tax on it when I sell it.That is foolish. If you mine $10,000 worth of BTC at a cost basis of $0, and then sell it for $10,000 you owe taxes on $10,000 worth of capital gains. If you mine $10,000, claim it as income, and then sell it for $10,000 then you owe $0 in capital gains and you can write off your equipment, electricity, etc. against the $10,000 of income. And you don't think if you get audited a cost basis of $0 isn't going to be a red flag?

You should find a new tax guy.

If there was a way to enforce $9 per kWh for anything that mines it would be dead for sure! ;-)

Then, instead of swatting, the scofflaws would just trick said system into charging the target's gaming GPU that it's being used for mining. They get a multi thousand dollar electric bill, can't pay it, gets shut off, poof! No one dies. ;-)

Then, instead of swatting, the scofflaws would just trick said system into charging the target's gaming GPU that it's being used for mining. They get a multi thousand dollar electric bill, can't pay it, gets shut off, poof! No one dies. ;-)

kirbyrj

Fully [H]

- Joined

- Feb 1, 2005

- Messages

- 30,729

If you mine with claimed expenses you have to pay income tax, and self employment tax, social security tax etc. If he does it the way he’s doing it, then all he is paying is electricity, but no tax until he cashed out. I do think “hobby mining” fits for some. That’s how I’m doing it. Except I am paying income tax on it and declaring it so that I can only pay long term capital gains tax on it when I sell it.

Ok, but even as a hobby miner, you're still going to have to claim mining as income with an actual cost basis.

I go back and forth on hobby mining vs. self employment mining. You can virtually write off anything that ties to mining (internet, electricity, equipment, "office space," etc.). If you keep good records, it probably offsets the self employment taxes and then some.

Axman

VP of Extreme Liberty

- Joined

- Jul 13, 2005

- Messages

- 17,717

Sin taxes are evil, and miners mostly set up in countries with geothermal. These countries are happy to have business other than smelting aluminum.If there was a way to enforce $9 per kWh for anything that mines it would be dead for sure! ;-)

It was mostly, mostly sarcastic BUT sometimes one has to fight fire with fire.Sin taxes are evil, and miners mostly set up in countries with geothermal. These countries are happy to have business other than smelting aluminum.

The amount of resources for (abstract resultant) computing is ridiculous. With all the problems in the world those compute cycles could actually be used for something useful. I suppose the same could be said about gaming too. ;-)

sfsuphysics

[H]F Junkie

- Joined

- Jan 14, 2007

- Messages

- 16,037

I agree sin taxes are evil, within reason, but I'm not about to stray off topic with that.Sin taxes are evil, and miners mostly set up in countries with geothermal. These countries are happy to have business other than smelting aluminum.

However I would question the "mostly" statement, while sure a good number might I doubt most miners are going to be in geothermal power producing parts of the world.

Plus what's wrong with smelting aluminum? It helps make low education good quality jobs, makes a resource that actually is used world wide, and can do so relatively pollution free*

Getting closer:

https://www.hardwaretimes.com/nvidi...y-hacked-ether-hash-rate-of-53-mh-s-unlocked/

Only showing results after 3 minutes, but better than the 45 seconds or so before...

https://www.hardwaretimes.com/nvidi...y-hacked-ether-hash-rate-of-53-mh-s-unlocked/

Only showing results after 3 minutes, but better than the 45 seconds or so before...

kirbyrj

Fully [H]

- Joined

- Feb 1, 2005

- Messages

- 30,729

No hacking needed for yall miners to get 50 mh on the 3060. Just download the nvidia driver from the developer portal

The hardest part about this is finding the driver. Nvidia won't let you download it unless you're registered as a developer. Found a copy on Mega upload.

Its free to sign up and anyone can do it.The hardest part about this is finding the driver. Nvidia won't let you download it unless you're registered as a developer. Found a copy on Mega upload.

kirbyrj

Fully [H]

- Joined

- Feb 1, 2005

- Messages

- 30,729

Has anyone around here actually tested this yet?

GoldenTiger

Fully [H]

- Joined

- Dec 2, 2004

- Messages

- 30,009

Of course not. Yet, teens will say it is "hacking" like guessing the password to mom's Facebook account.nVidia makes driver available == "got hacked"

Okay. Dumb move by nVidia, but is this hacking?

It's fake. Downloaded the driver straight from Nvidia's dev site. Did a clean install. Did not work. Ran DDU in safe mode with Ethernet disconnected. Then installed the dev driver still with Ethernet disconnected.

Rebooted and started mining:

UPDATE:

Got it working. Trick is the 3060 has to be the primary GPU with a monitor connected to it. So this probably won't work in a rig with multiple 3060's.

Rebooted and started mining:

UPDATE:

Got it working. Trick is the 3060 has to be the primary GPU with a monitor connected to it. So this probably won't work in a rig with multiple 3060's.

Last edited:

legcramp

[H]F Junkie

- Joined

- Aug 16, 2004

- Messages

- 12,424

I wonder if a hdmi dummy plug would work instead of having a monitor connected + primary GPU.

kirbyrj

Fully [H]

- Joined

- Feb 1, 2005

- Messages

- 30,729

"Driver are currently not available - please check back again, thank you."

If you search around you could probably find a copy. I don't have the Nvidia version, I only have one I DL'd from Megaupload. I don't even have a 3060 to try it with yet.

Got it working. Trick is the 3060 has to be the primary GPU with a monitor connected to it. So this probably won't work in a rig with multiple 3060's.

pclausen I think the issue may be 1x riser incompatibility. Direct-plugged to motherboard slot apparently works for multiples. I don't have one to test, but try it out.

Last edited:

D

Deleted member 162929

Guest

Multiple sites claiming that’s Octopus, not Daggerhashimoto. So not ETH. Until a full screenshot is provided it’s probably fake.

As a confirmation, the news outlet has posted a picture of the NVIDIA GeForce RTX 3060 mining Ethereum cryptocurrency using the Daggerhashimoto algorithm (T-REX) and delivering a total of around 50 MH/s. A single GPU was used which had an average power consumption of 110 Watt with fans set to 70% and the temperatures averaging around 33C (Degrees). The ETH Cryptomining algorithm was left running for 8 minutes which confirms that the limit has indeed been bypassed as earlier rumors only had the GPU running for less than 5 minutes which isn't enough time for the hash rate limiter to kick in.

https://wccftech.com/nvidia-geforce...rate-limit-bypassed-hacked-rtx-3060-ethereum/

kirbyrj

Fully [H]

- Joined

- Feb 1, 2005

- Messages

- 30,729

That's pretty much old news at this point (a week or more). Have to use the 470.05 driver, have to run at least x8 bandwidth, and have to have a monitor or dummy plug plugged in from what I've seen.

Archaea

[H]F Junkie

- Joined

- Oct 19, 2004

- Messages

- 11,837

Nobody hacked it. That's publicly available development drivers that NVidia neglected to lock down.

Rather a big mistake it would seem. Once those drivers hit the main stream, and apparently you can register to get them for free - that should keep that genie out of the bottle -- at least for the 3060.

D

Deleted member 162929

Guest

Nobody hacked it. That's publicly available development drivers that NVidia neglected to lock down.

Rather a big mistake it would seem. Once those drivers hit the main stream, and apparently you can register to get them for free - that should keep that genie out of the bottle -- at least for the 3060.

I was just addressing the point of 'Daggerhashimoto'/T-Rex

![[H]ard|Forum](/styles/hardforum/xenforo/logo_dark.png)