Hi guys,

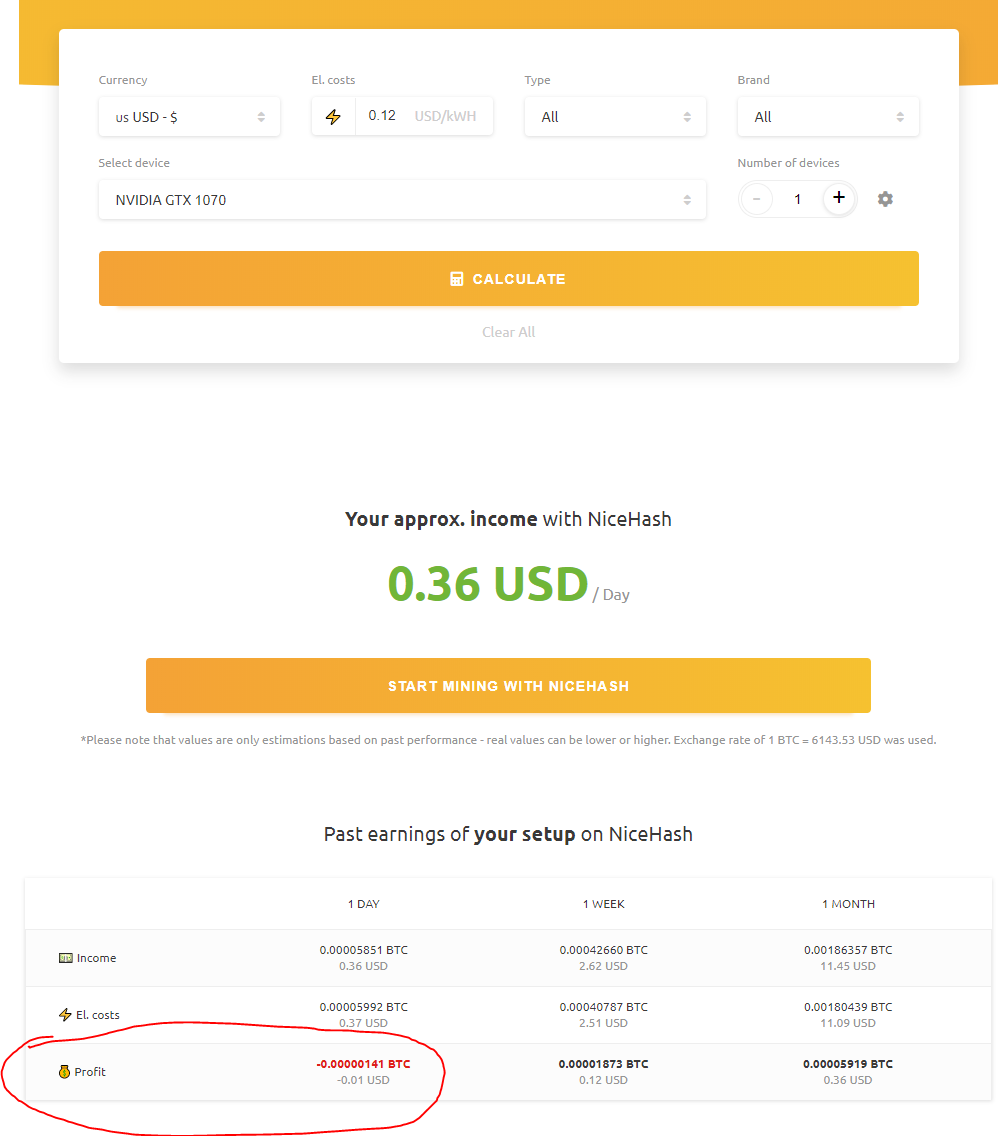

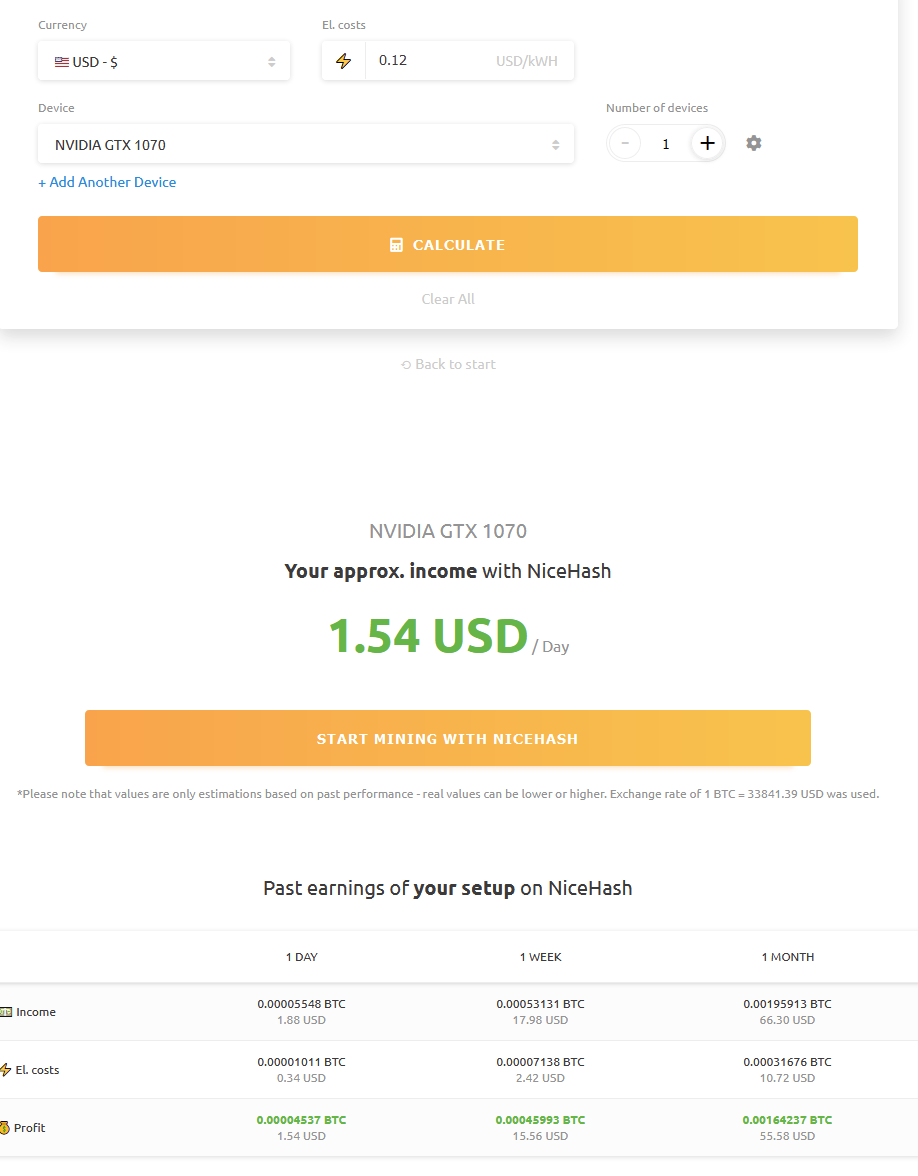

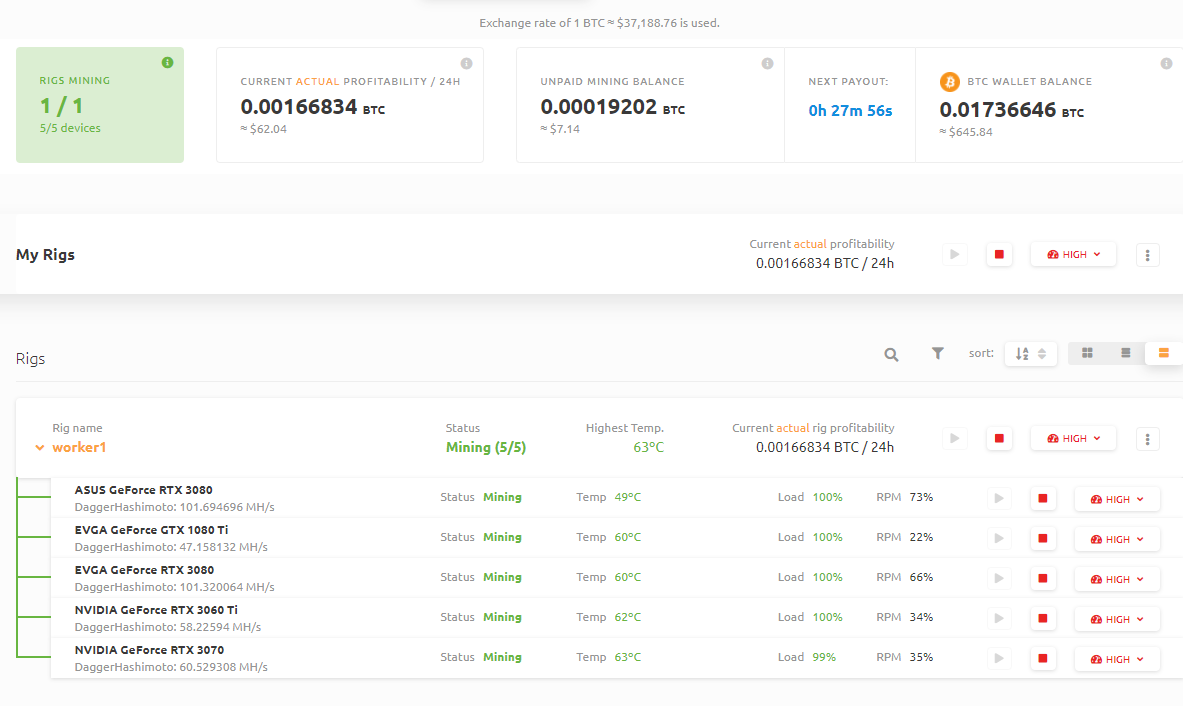

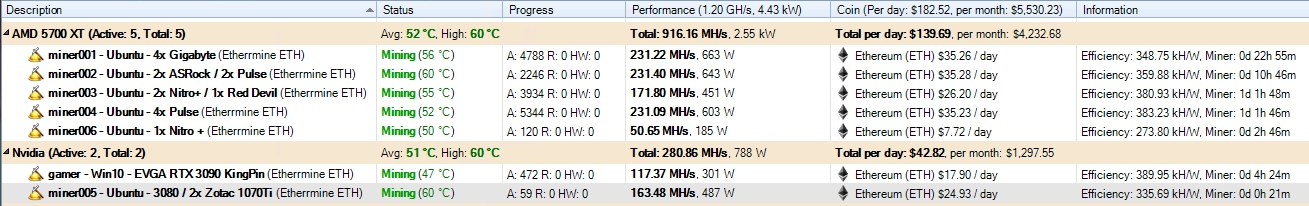

Wondering how profitable it actually is to get into crypto mining.

How much one could expect as an initial investment to get running, the cost to run the server, and the expected payout?

Maybe if you mine, let me know your return rate?

I've always played with the idea of making a mining box, but I just really don't know if it would be worth it.

Wondering how profitable it actually is to get into crypto mining.

How much one could expect as an initial investment to get running, the cost to run the server, and the expected payout?

Maybe if you mine, let me know your return rate?

I've always played with the idea of making a mining box, but I just really don't know if it would be worth it.

![[H]ard|Forum](/styles/hardforum/xenforo/logo_dark.png)