DistortedMinds

n00b

- Joined

- Feb 6, 2021

- Messages

- 7

Hi everyone,

I'm completely new to this world and was looking for some expert advise.

The story is, me and my friend have recently stumbled across cryptocurrency mining, we started looking into things and found out about a small mining rig and before long we got to the point where we where virtually going to start building our own 12 x GPU rig.

We ordered the following:

1 x 18 way GPU frame

1 x Asus B250 mining expert motherboard

1 x i7 Intel processor

1 x 16GB DDR4 RAM

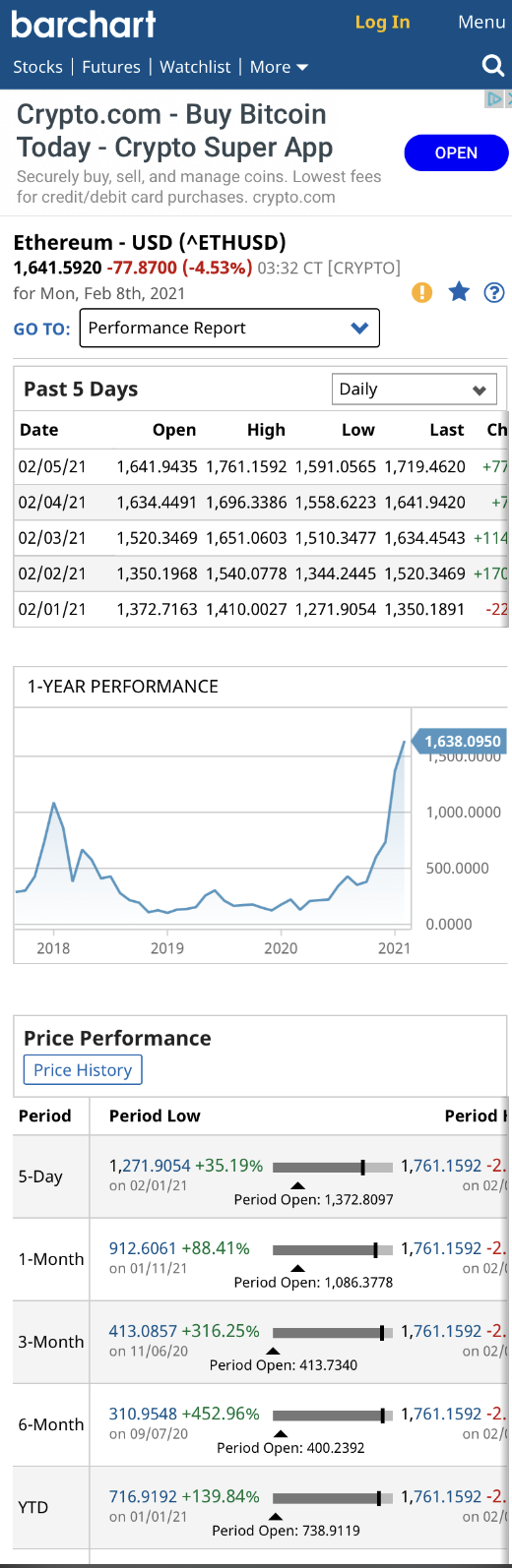

We had a storage location and then just when we was about to order the PSU, USB risers, HDD, power button, handheld wallet, wattage monitor and finally a couple of NVIDIA RTX 3080's to get rocking and rolling we found out about phase 1.5 of Ethereum and Ethereum 2.0. We where absolutely gutted, now I'm convinced this isn't the end of mining so this is where I need some help.

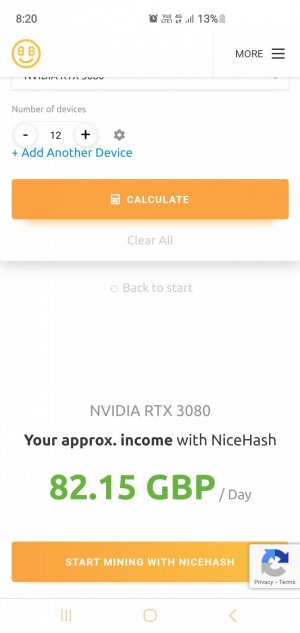

We have looked into Nicehash for either renting your hash rate or mining on there which seems to be Bitcoin mining which I don't get as I thought you was supposed to have incredible amounts of power to make this profitable but from the calculator on there site it seems to be quite profitable and again with renting out hash rate.

I was also looking into Zcash and wondered if anyone else has any experiance mining this crypto currency or any others for that matter that will be a decent-ish passive income.

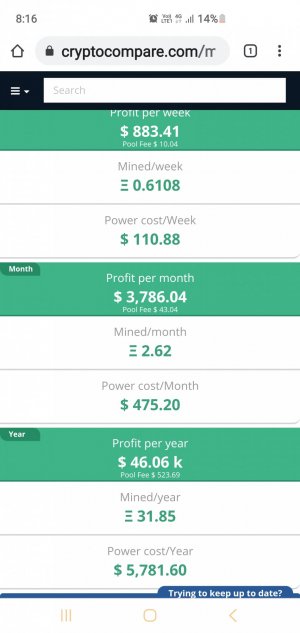

We figured with a 12 GPU rig we'd have about 1000 Mh/s maybe more from overclocking and running at about 3000 watts with power reduction. Our electricity rate is about 0.16 kW/h which is roughly 0.22 kW/h in USD so after a while we was going to set up a small solar unit to power this.

I really hope someone can shed some light on this, I hope we are not doomed as I loved the idea of mining and its certainly something I find fascinating. Thank you for any advice in advance and I look forward to hearing from you.

I'm completely new to this world and was looking for some expert advise.

The story is, me and my friend have recently stumbled across cryptocurrency mining, we started looking into things and found out about a small mining rig and before long we got to the point where we where virtually going to start building our own 12 x GPU rig.

We ordered the following:

1 x 18 way GPU frame

1 x Asus B250 mining expert motherboard

1 x i7 Intel processor

1 x 16GB DDR4 RAM

We had a storage location and then just when we was about to order the PSU, USB risers, HDD, power button, handheld wallet, wattage monitor and finally a couple of NVIDIA RTX 3080's to get rocking and rolling we found out about phase 1.5 of Ethereum and Ethereum 2.0. We where absolutely gutted, now I'm convinced this isn't the end of mining so this is where I need some help.

We have looked into Nicehash for either renting your hash rate or mining on there which seems to be Bitcoin mining which I don't get as I thought you was supposed to have incredible amounts of power to make this profitable but from the calculator on there site it seems to be quite profitable and again with renting out hash rate.

I was also looking into Zcash and wondered if anyone else has any experiance mining this crypto currency or any others for that matter that will be a decent-ish passive income.

We figured with a 12 GPU rig we'd have about 1000 Mh/s maybe more from overclocking and running at about 3000 watts with power reduction. Our electricity rate is about 0.16 kW/h which is roughly 0.22 kW/h in USD so after a while we was going to set up a small solar unit to power this.

I really hope someone can shed some light on this, I hope we are not doomed as I loved the idea of mining and its certainly something I find fascinating. Thank you for any advice in advance and I look forward to hearing from you.

![[H]ard|Forum](/styles/hardforum/xenforo/logo_dark.png)