Andrew_Carr

2[H]4U

- Joined

- Feb 26, 2005

- Messages

- 2,777

So I wanted to run some numbers to see if it makes sense to be a miner full-time. I think we all know that during bull markets like right now, mining is great. But I wanted to see if it's worth getting into mining in the middle of a bull market when GPU prices are already sky-high and availability is slim. Basically, does it make sense for the everyday Joe to invest money into mining without the full-benefit of commercial power rates, standardized rigs, experience, etc? Here are my findings:

Methodology: Take a budget of about $25,000 and allocate it towards the most cost efficient hardware. The limiting factor is generally going to be GPUs at low prices, so if something cheap is listed on ebay/Craigslist/[H]/FBM, "buy" it immediately and remove that from the overall budget. Generally we're looking at GPUs with ROIs of less than 6 months as of the sale date. ROI is calculated roughly via Whattomine and kryptex.org before deciding if a GPU is a good buy or not. CPUs, Motherboards, RAM, and PSUs are all plentiful in supply and at MSRP so that's generally what I've used. It's possible sometimes to buy stuff used for cheaper, so you could probably take off 10-20% from my other expenses.

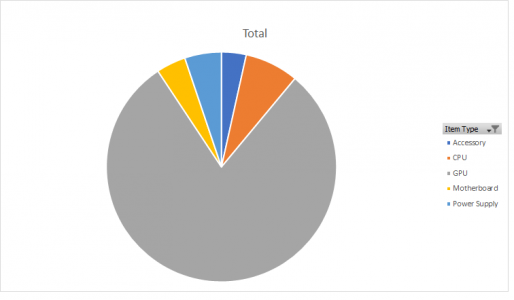

1.) Distribution of Costs by equipment type (see graph)

What I've found is that, unsurprisingly, GPUs are the largest expense. This is followed by CPUs, Motherboards, and then Accessories. From my experience Accessories should probably be a little higher depending on how you set things up. If you buy expensive $150 mining rig setups and spend awhile finding the right fans, cables, etc., I would say Accessories would be the #2 expense at around $2k or around 10% of your total expenses. This is avoidable, but it's something you need to watch out for so you don't waste money on items not earning you any direct profit.

Power supplies are consumer level power supplies. The positive to this is that you can run these in your home without going deaf and keep things relatively normal, the negative is increased power costs and increased equipment costs. Using server power supplies would decrease your upfront expenses by about 50% or more but might not be a good fit for everyone.

Rough Cost Breakdown (On a $22-25k budget)

Accessory $795 3.47%

CPU $1730 7.56%

GPU $18242.85 79.67%

Motherboard $950 4.15%

Power Supply $1180 5.15%

(I left out RAM, and probably didn't account for all the misc. costs so I would increase the Accessory amount to roughly $1500 or so).

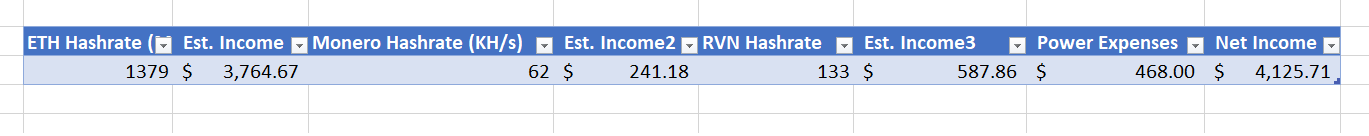

2.) Income

So you've spent $25k in mining hardware at peak levels, so what does that get you? Well, at a hashrate of about 1,379 MH/s (ETH), 133 MH/s (RVN), and 62 KH/s (XMR), that gets you a net income of about $4,125 per month after subtracting $468 or so in power @ $0.10 / kWh. Your ROI is now approximately 6 months.

3.) Summary & Conclusion

So can it make sense to get into mining after it's already "too late"? Yes, if you consider the following.

a.) Monero Mining has a much longer ROI. With my example numbers, you're paying about $1700 (CPUs) and $500 (Motherboards) above a "baseline" cheapo mining setup of $50 motherboards and $5 CPUs. This nets you an extra $241 / month in XMR revenue so you'd pay off the difference in about 10 months. GPUs for comparison would be on the order of 3-6 months ROI. So it can make sense to buy up Ryzen CPUs at good prices if you want to do this long-term, but you're not going to be making any profit for awhile.

b.) If you can get good prices (see below) then it can make sense. If you're paying scalper prices then probably not unless you're ok with no profit for a year and can eat the losses if you sell everything after a crash. If you're buying older, power inefficient cards, you need to make ROI quickly so that you can be safe in the event of a crash. If you have power efficient hardware you'll probably remain profitable throughout a crash, but you'll be earning much less so it's risky of course to bet on making a consistent income on this.

So what would it take to make it full-time? I would say that at least 10x this in upfront capital would be needed. You would be able to reduce your accessory costs significantly and you would have lower operational costs (electric bill), but during a crash I think you'd want significantly more hashing power than this to be comfortable and you'd want to have the latest, most power efficient hardware as well.

Does it make sense to just buy & resell instead? Maybe. If you're limited by power, then as long as you have a steady supply of cheap GPUs you can resell a portion to recoup your initial investment faster. If you're not limited by space/power then I think it makes more sense to put your GPUs to work immediately while the money is best.

Is it better to bargain hunt or just buy GPUs at scalper prices? Buying at scalper prices would probably double your GPU costs at a minimum, at the benefit of getting you more power efficient cards that are future-proofed better.

Is it better to buy one "big" card (ie. RTX 3080 @ 100MH/s) or two "small" cards (ie. 2 x Vega56 @ 50MH/s)? There is definitely a point in favor of less cards = less headache, but the additional cost of risers, motherboards, CPUs, etc. is fairly small. I saw someone selling their entire RX 470 mining setup of 100+ cards plus risers, PSUs, etc. back in January at $125/card and that would've been a great buy despite the added headache.

Data / Further Information:

-Notional $25k spent on hardware total

-Mixture of Algorithms (ETH, RVN, XMR). FIRO looks to require additional setup costs so I didn't include it, and if all ETH GPUs switched to Ravencoin mining (ie. after ETH PoS transition) some of the bang/buck situations would change (ie. an RX 470 becomes relatively better, while a vega56 loses some of its advantages).

-Instead of using cheap motherboards and CPUs, all motherboards and CPUs are Ryzen 3600 or higher for extra XMR income

- Approximately 5-10% DOA rate on GPUs

-Only a few items bought new and at MSRP (Microcenter finds, lucky catches online). Not a consistent source of supply so they only make up approximately 10% of the GPUs

GPU Prices:

GTX 1080TI: $600-700

GTX 1080: $400-500

GTX 1070: $300-400

5700XT: $500-800

Vega56: $300-400

GTX 1060: $200-300

RX470: $150

CPU / Accessory Prices:

Ryzen 3600: $200

Motherboards: $75-100

Baseline CPU + Motherboard Combos: $55

PSUs: $200 / rig roughly

Baseline PSUs: $60-100 / rig (if using server power supplies on 220V)

RAM: $20-80 / rig

Mining Specific Cases/frames: $150

Baseline Cases/frames for rigs: $20 Home Depot shelves

Risers & Fans: $100 / rig roughly

Theoretical GPU List:

5700XT x 3

GTX 1080 TI x 6

GTX 1080 x 3

GTX 1070 x 8

Vega56 x 7

RX 470 x 11

RTX 3080 x 1

RTX 3060 x 1

These are all prices I've seen items sold for online in the past 3 months. Prices on older 4GB cards have risen dramatically, but the others you can still occasionally find deals on. I know this is much lower than the going rate in some cases so this probably won't work if you're trying to buy hundreds of cards at once, but if you have time to bargain hunt then it's worth doing.

TLDR: Reduce your GPU expenses as much as possible, then try to save on the rest.

Methodology: Take a budget of about $25,000 and allocate it towards the most cost efficient hardware. The limiting factor is generally going to be GPUs at low prices, so if something cheap is listed on ebay/Craigslist/[H]/FBM, "buy" it immediately and remove that from the overall budget. Generally we're looking at GPUs with ROIs of less than 6 months as of the sale date. ROI is calculated roughly via Whattomine and kryptex.org before deciding if a GPU is a good buy or not. CPUs, Motherboards, RAM, and PSUs are all plentiful in supply and at MSRP so that's generally what I've used. It's possible sometimes to buy stuff used for cheaper, so you could probably take off 10-20% from my other expenses.

1.) Distribution of Costs by equipment type (see graph)

What I've found is that, unsurprisingly, GPUs are the largest expense. This is followed by CPUs, Motherboards, and then Accessories. From my experience Accessories should probably be a little higher depending on how you set things up. If you buy expensive $150 mining rig setups and spend awhile finding the right fans, cables, etc., I would say Accessories would be the #2 expense at around $2k or around 10% of your total expenses. This is avoidable, but it's something you need to watch out for so you don't waste money on items not earning you any direct profit.

Power supplies are consumer level power supplies. The positive to this is that you can run these in your home without going deaf and keep things relatively normal, the negative is increased power costs and increased equipment costs. Using server power supplies would decrease your upfront expenses by about 50% or more but might not be a good fit for everyone.

Rough Cost Breakdown (On a $22-25k budget)

Accessory $795 3.47%

CPU $1730 7.56%

GPU $18242.85 79.67%

Motherboard $950 4.15%

Power Supply $1180 5.15%

(I left out RAM, and probably didn't account for all the misc. costs so I would increase the Accessory amount to roughly $1500 or so).

2.) Income

So you've spent $25k in mining hardware at peak levels, so what does that get you? Well, at a hashrate of about 1,379 MH/s (ETH), 133 MH/s (RVN), and 62 KH/s (XMR), that gets you a net income of about $4,125 per month after subtracting $468 or so in power @ $0.10 / kWh. Your ROI is now approximately 6 months.

3.) Summary & Conclusion

So can it make sense to get into mining after it's already "too late"? Yes, if you consider the following.

a.) Monero Mining has a much longer ROI. With my example numbers, you're paying about $1700 (CPUs) and $500 (Motherboards) above a "baseline" cheapo mining setup of $50 motherboards and $5 CPUs. This nets you an extra $241 / month in XMR revenue so you'd pay off the difference in about 10 months. GPUs for comparison would be on the order of 3-6 months ROI. So it can make sense to buy up Ryzen CPUs at good prices if you want to do this long-term, but you're not going to be making any profit for awhile.

b.) If you can get good prices (see below) then it can make sense. If you're paying scalper prices then probably not unless you're ok with no profit for a year and can eat the losses if you sell everything after a crash. If you're buying older, power inefficient cards, you need to make ROI quickly so that you can be safe in the event of a crash. If you have power efficient hardware you'll probably remain profitable throughout a crash, but you'll be earning much less so it's risky of course to bet on making a consistent income on this.

So what would it take to make it full-time? I would say that at least 10x this in upfront capital would be needed. You would be able to reduce your accessory costs significantly and you would have lower operational costs (electric bill), but during a crash I think you'd want significantly more hashing power than this to be comfortable and you'd want to have the latest, most power efficient hardware as well.

Does it make sense to just buy & resell instead? Maybe. If you're limited by power, then as long as you have a steady supply of cheap GPUs you can resell a portion to recoup your initial investment faster. If you're not limited by space/power then I think it makes more sense to put your GPUs to work immediately while the money is best.

Is it better to bargain hunt or just buy GPUs at scalper prices? Buying at scalper prices would probably double your GPU costs at a minimum, at the benefit of getting you more power efficient cards that are future-proofed better.

Is it better to buy one "big" card (ie. RTX 3080 @ 100MH/s) or two "small" cards (ie. 2 x Vega56 @ 50MH/s)? There is definitely a point in favor of less cards = less headache, but the additional cost of risers, motherboards, CPUs, etc. is fairly small. I saw someone selling their entire RX 470 mining setup of 100+ cards plus risers, PSUs, etc. back in January at $125/card and that would've been a great buy despite the added headache.

Data / Further Information:

-Notional $25k spent on hardware total

-Mixture of Algorithms (ETH, RVN, XMR). FIRO looks to require additional setup costs so I didn't include it, and if all ETH GPUs switched to Ravencoin mining (ie. after ETH PoS transition) some of the bang/buck situations would change (ie. an RX 470 becomes relatively better, while a vega56 loses some of its advantages).

-Instead of using cheap motherboards and CPUs, all motherboards and CPUs are Ryzen 3600 or higher for extra XMR income

- Approximately 5-10% DOA rate on GPUs

-Only a few items bought new and at MSRP (Microcenter finds, lucky catches online). Not a consistent source of supply so they only make up approximately 10% of the GPUs

GPU Prices:

GTX 1080TI: $600-700

GTX 1080: $400-500

GTX 1070: $300-400

5700XT: $500-800

Vega56: $300-400

GTX 1060: $200-300

RX470: $150

CPU / Accessory Prices:

Ryzen 3600: $200

Motherboards: $75-100

Baseline CPU + Motherboard Combos: $55

PSUs: $200 / rig roughly

Baseline PSUs: $60-100 / rig (if using server power supplies on 220V)

RAM: $20-80 / rig

Mining Specific Cases/frames: $150

Baseline Cases/frames for rigs: $20 Home Depot shelves

Risers & Fans: $100 / rig roughly

Theoretical GPU List:

5700XT x 3

GTX 1080 TI x 6

GTX 1080 x 3

GTX 1070 x 8

Vega56 x 7

RX 470 x 11

RTX 3080 x 1

RTX 3060 x 1

These are all prices I've seen items sold for online in the past 3 months. Prices on older 4GB cards have risen dramatically, but the others you can still occasionally find deals on. I know this is much lower than the going rate in some cases so this probably won't work if you're trying to buy hundreds of cards at once, but if you have time to bargain hunt then it's worth doing.

TLDR: Reduce your GPU expenses as much as possible, then try to save on the rest.

Attachments

Last edited:

![[H]ard|Forum](/styles/hardforum/xenforo/logo_dark.png)