thunderstruck!

[H]ard|Gawd

- Joined

- Nov 14, 2005

- Messages

- 1,686

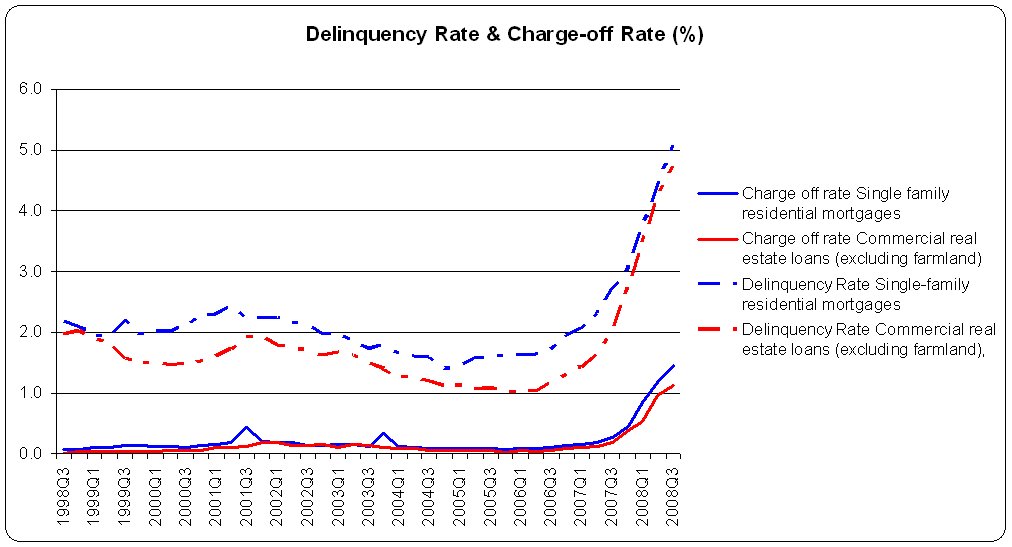

You are grossly exaggerating the problem of those defaulting on their mortgage because they are unable to pay. Let's take a look at the default rate for the last several years. Then compare it to your statement. As you can see, the rates were fairly flat for most of the last 8 years. So there were vastly, vastly more people who paid their bills than those who did not.lol, it doesn't matter.. when the regulation puts the market in that situation, it's the only way they can make their money back since nobody is making their payments. They just pass the buck to the next..

![[H]ard|Forum](/styles/hardforum/xenforo/logo_dark.png)