cageymaru

Fully [H]

- Joined

- Apr 10, 2003

- Messages

- 22,091

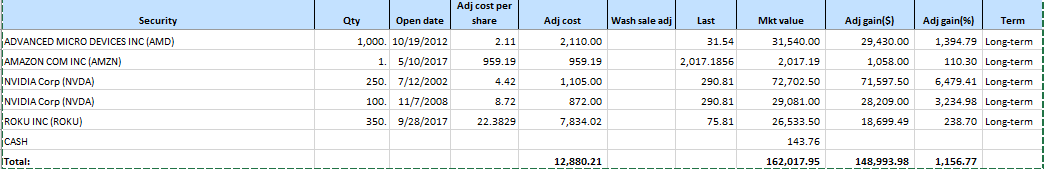

NVIDIA has seen its stock reach all time highs as it surged 3% to $289.36 at the close of trading today. The stock was able to eclipse the $292.06 mark briefly during the day. This means that NVIDIA stock is up 50% for the year. Analysts don't believe that AMD will launch a new graphics card in 2018 to challenge NVIDIA and gamers will flock to Turing for real-time ray tracing. NVIDIA will remain unchallenged in the datacenter for the foreseeable future.

For their part, shares of AMD closed up 1.7% at $31.42, below their 12-year closing high of $32.72. AMD currently ranks as the best performing stock on the S&P 500 for the year with a 206% gain.

For their part, shares of AMD closed up 1.7% at $31.42, below their 12-year closing high of $32.72. AMD currently ranks as the best performing stock on the S&P 500 for the year with a 206% gain.

![[H]ard|Forum](/styles/hardforum/xenforo/logo_dark.png)