Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Ars Technica article: No end to chip shortages

- Thread starter philb2

- Start date

harmattan

Supreme [H]ardness

- Joined

- Feb 11, 2008

- Messages

- 5,129

Not surprising. There seems to be an ever-augmenting convolution of factors worsening the situation.

In my view, we're never going back to "normal" with chip prices i.e. what we've seen previously in supply and demand, at least not for a (human) generation. They've proven to be a hugely valuable commodity for so many applications (some that are experiencing gale-force tailwinds), and are embedded thoroughly into the fabric of our lives. The needle will move back some, but not much.

In my view, we're never going back to "normal" with chip prices i.e. what we've seen previously in supply and demand, at least not for a (human) generation. They've proven to be a hugely valuable commodity for so many applications (some that are experiencing gale-force tailwinds), and are embedded thoroughly into the fabric of our lives. The needle will move back some, but not much.

Not surprising. There seems to be an ever-augmenting convolution of factors worsening the situation.

In my view, we're never going back to "normal" with chip prices i.e. what we've seen previously in supply and demand, at least not for a (human) generation. They've proven to be a hugely valuable commodity for so many applications (some that are experiencing gale-force tailwinds), and are embedded thoroughly into the fabric of our lives. The needle will move back some, but not much.

I'm curious what GenMay thinks on this effect spreading way beyond chips.

Everyone and their mother seems to be sitting on dry powder in the event of another 2008 like crash. I don't think one is coming. So much money has been printed, unemployment is low, consumer demand is high.

I think what we're going to see is a readjustment of prices to the higher end, possibly forever. Unless we get another black swan event, I suspect housing, autos, consumer goods, etc, are now priced into a new normal range.

I think COVID just sped up the timeline on supply shortages that were already going to happen.

We were already building too little entry level housing post-2008-2011. Entire industries became too reliant on JIT manufacturing and warehousing. It was the perfect storm and I doubt we're going to get un-fucked from this for the foreseeable future.

Big changes are happening which will speed up with the price increases I predict. Robotics replacing more and more the functions of people on a number of jobs -> more chips -> millions of chips not just for worker replacement but also home use robotics from cleaning machines, cutting grass, other cleaning type uses to cooking. More and more driving vehicles -> reduced truckers -> replaced with self driving trucks or smaller loads in smaller vehicles and drones (endless # of drones). Medical field -> more chips in virtually every area. The conversion of traditional means of electrical power to a more a green source -> more chips for control, measurement, conversions and feedback. Most TVs are now smart, meaning a CPU, all TVs will most likely become Smart TVs. Smarter medical devices for monitoring, checking and testing -> more chips. The demand is exploding, use cases are going up exponentially, wait in line and pay the price for them. Virtually in every area of people lives more chips are being used, most would say to enhance their lives others would be more concerned on the outcome of all the changes. GPUs are no longer a dedicated or purely designed for games, their usefulness have far outreached gaming which in itself has issued in new technologies from AI to Visuals, media of all types. Yet some folks think it is all due to Crypto mining

KazeoHin

[H]F Junkie

- Joined

- Sep 7, 2011

- Messages

- 9,004

Inflation is a bitch.

pippenainteasy

[H]ard|Gawd

- Joined

- May 20, 2016

- Messages

- 1,158

well INTC is still kinda cheap if you want to profit off of that I guess...assuming they remain semi competitive and next iterations of zen don't just destroy them completely lol

CPU prices are already going "normal" with Zen 3 price cuts after Alder Lake.Not surprising. There seems to be an ever-augmenting convolution of factors worsening the situation.

In my view, we're never going back to "normal" with chip prices i.e. what we've seen previously in supply and demand, at least not for a (human) generation. They've proven to be a hugely valuable commodity for so many applications (some that are experiencing gale-force tailwinds), and are embedded thoroughly into the fabric of our lives. The needle will move back some, but not much.

GPU prices would be already seeing the same development... if it wasn't for the cryptos.

And this is a fact, without even the new production capability that is coming up in the US and elsewhere few years down the line.

Fix all the broken stuff, make robots, program and hit the beach, drink beer. Just some ideas.

harmattan

Supreme [H]ardness

- Joined

- Feb 11, 2008

- Messages

- 5,129

That's what I was getting at. Demand is going to continue to outstrip any supply increase for years to come. What I'm seeing now in datacenters alone is staggering as firms are now full-force moving processing off-site (and for the stuff they're keeping onsite they need top-of-the-line stuff). That said, you might be able to find used Haswell Xeons aplenty for the next few yearsBig changes are happening which will speed up with the price increases I predict. Robotics replacing more and more the functions of people on a number of jobs -> more chips -> millions of chips not just for worker replacement but also home use robotics from cleaning machines, cutting grass, other cleaning type uses to cooking. More and more driving vehicles -> reduced truckers -> replaced with self driving trucks or smaller loads in smaller vehicles and drones (endless # of drones). Medical field -> more chips in virtually every area. The conversion of traditional means of electrical power to a more a green source -> more chips for control, measurement, conversions and feedback. Most TVs are now smart, meaning a CPU, all TVs will most likely become Smart TVs. Smarter medical devices for monitoring, checking and testing -> more chips. The demand is exploding, use cases are going up exponentially, wait in line and pay the price for them. Virtually in every area of people lives more chips are being used, most would say to enhance their lives others would be more concerned on the outcome of all the changes. GPUs are no longer a dedicated or purely designed for games, their usefulness have far outreached gaming which in itself has issued in new technologies from AI to Visuals, media of all types. Yet some folks think it is all due to Crypto mining

And crypto isn't going away anytime soon, and is certainly an influence (one of several).

Andrew_Carr

2[H]4U

- Joined

- Feb 26, 2005

- Messages

- 2,777

Can you elaborate what you're seeing that's crazy in datacenter? I can confirm haswell xeons are dirt cheap though. Like $2-3 / chip sometimes.That's what I was getting at. Demand is going to continue to outstrip any supply increase for years to come. What I'm seeing now in datacenters alone is staggering as firms are now full-force moving processing off-site (and for the stuff they're keeping onsite they need top-of-the-line stuff). That said, you might be able to find used Haswell Xeons aplenty for the next few years

And crypto isn't going away anytime soon, and is certainly an influence (one of several).

harmattan

Supreme [H]ardness

- Joined

- Feb 11, 2008

- Messages

- 5,129

Every cloud provider is in a mad rush to upgrade compute capacity since large enterprises have finally cracked the nut (and security concerns, stigma etc.) of moving compute to the cloud. In parallel, businesses are finally figuring out how to embed AI/ML to automate everything including payments and receivables -- and move it to the cloud -- so yet more demand for BPaaS. In addition, big Finance is starting to do in-house crypto proof of work as well as moving towards (even more) algo-heavy endeavours. My company's datacenter (one of the big guys in its industry) is struggling to keep up with the crazy need for compute we're (myself included) are throwing at it, and my peers at competitors have said the same.Can you elaborate what you're seeing that's crazy in datacenter? I can confirm haswell xeons are dirt cheap though. Like $2-3 / chip sometimes.

Andrew_Carr

2[H]4U

- Joined

- Feb 26, 2005

- Messages

- 2,777

Ah, that makes sense. I keep hoping for some event that will see somewhat modern hardware dumped onto the market (ie. stadia going bust and selling off all their accelerators) but I guess the stuff we all want would be in the cloud datacenters and businesses will just offload outdated stuff.Every cloud provider is in a mad rush to upgrade compute capacity since large enterprises have finally cracked the nut (and security concerns, stigma etc.) of moving compute to the cloud. In parallel, businesses are finally figuring out how to embed AI/ML to automate everything including payments and receivables -- and move it to the cloud -- so yet more demand for BPaaS. In addition, big Finance is starting to do in-house crypto proof of work as well as moving towards (even more) algo-heavy endeavours. My company's datacenter (one of the big guys in its industry) is struggling to keep up with the crazy need for compute we're (myself included) are throwing at it, and my peers at competitors have said the same.

Just in time manufacturing forgot the saying "Save for a rainy day, be prepared". Assuming conditions cannot radically change on thousands of parts procured from hundreds of different sources for like a typical car, that they will arrive within if not on a given day is just plain idiotic. It is like building a house with all the workers showing up and expecting the nails will arrive in the morning, woood, electrical wiring or whatever -> when it doesn't then what? I had to put up with that mentality on my last job, not procuring items I know will be needed because not authorized (knowing history and expected breakdowns and critical parts needed). Shipping back items on the shelf to the company since they did the same thing, knowing if the line goes down (expected) that now we have a day vice a hour loss of production. You can only work so long with stupidity and it is better to let the stupid run with it while you find something smarter to do.

But here the issue is a giant higher demand for a very long time no, it is not like we have a chips issue because of timing issue in the supply chain that did lead to less chips being made.

I feel that the comments come from people that didn't like JIT before, never thought the cost saved and waste avoided was worth the augmented risk and assign the situation to it.

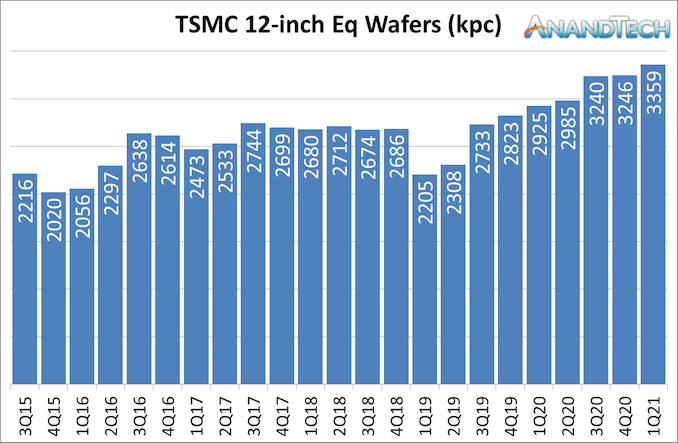

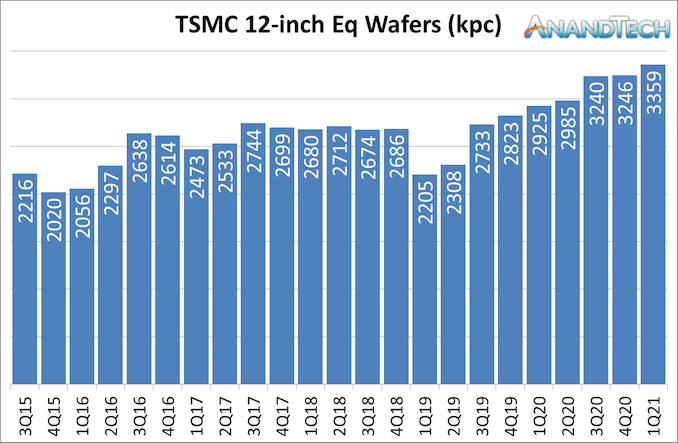

TSMC never made has much wafers in is history than Q32020-Q42020 and Q1 2021

TSMC shipped 3.36 million wafers this quarter (based on 12-inch equivalent wafers, because some production is 8-inch), or about 1.12 million per month, 8% more per month than the 2020 average.

The World does not seem to have been making significantly less chips in 4Q20 than the year before, if TSMC is similar to other they made much more, the issue seem an explosion in demand.

I feel that the comments come from people that didn't like JIT before, never thought the cost saved and waste avoided was worth the augmented risk and assign the situation to it.

TSMC never made has much wafers in is history than Q32020-Q42020 and Q1 2021

TSMC shipped 3.36 million wafers this quarter (based on 12-inch equivalent wafers, because some production is 8-inch), or about 1.12 million per month, 8% more per month than the 2020 average.

The World does not seem to have been making significantly less chips in 4Q20 than the year before, if TSMC is similar to other they made much more, the issue seem an explosion in demand.

Did you compare that cost versus the cost of having the warehouse capacity (and for chips like product, stock obsolescence)Shipping back items on the shelf to the company since they did the same thing knowing if the line goes down (expected) that now we have a day vice a hour loss of production.... stupidity

The cost was pennies compared to the loss of production even for one day. A $200-$300 Seimen module that if failed and you do not have one and they are no longer available to buy new can cost over $100,000/day production losses (being conservative here) on the biggest line. Seimen obsolescence or support comes a lot sooner than production line lifespan and you end up with equipment with no support. Company ended up spending millions on converting to Allen Bradley, all new software, cabinets etc. JIT for different industries does not work. Having it on the shelf even if thrown away, critical items would overall be available to maintain production. Items that are standard, easy to obtain, rapidly etc. do not need to be kept on the shelf. Being smart is just that, being start and not just ramming down some concept that just supposed to magically work in all cases. JIT has it places as in restaurants, huge manufacturing processes you have to weigh the consequences.But here the issue is a giant higher demand for a very long time no, it is not like we have a chips issue because of timing issue in the supply chain that did lead to less chips being made.

I feel that the comments come from people that didn't like JIT before, never thought the cost saved and waste avoided was worth the augmented risk and assign the situation to it.

View attachment 411613

TSMC never made has much wafers in is history than Q32020-Q42020 and Q1 2021

TSMC shipped 3.36 million wafers this quarter (based on 12-inch equivalent wafers, because some production is 8-inch), or about 1.12 million per month, 8% more per month than the 2020 average.

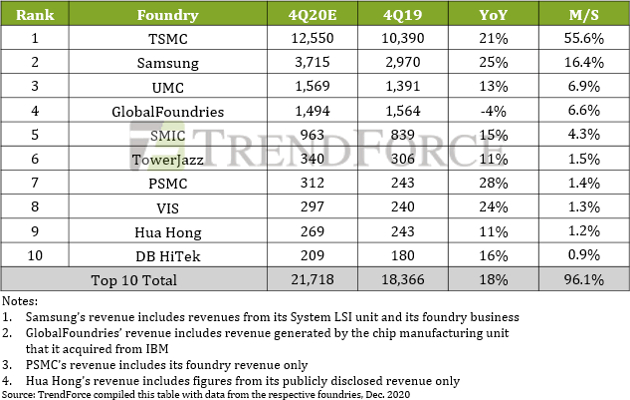

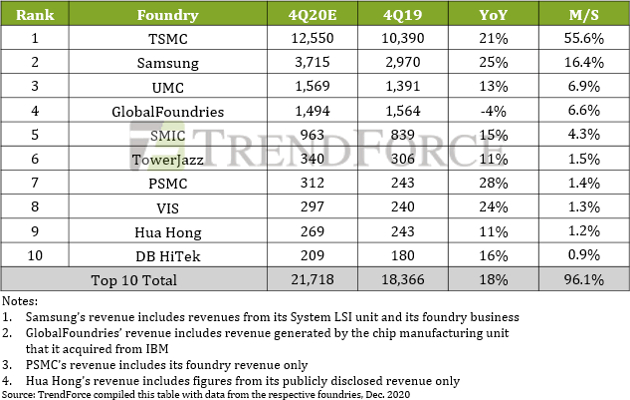

View attachment 411614

The World does not seem to have been making significantly less chips in 4Q20 than the year before, if TSMC is similar to other they made much more, the issue seem an explosion in demand.

Did you compare that cost versus the cost of having the warehouse capacity (and for chips like product, stock obsolescence)

That sound completely different than JIT, just in time from what I understand is the strategy that instead of having a giant warehouse with the land and staff for it, the would take place (or could change because you offer many options to the buyer of your product) entrants are received has needed, not the decision to have a backup or not for the tools and equipment used on a factory chain.The cost was pennies compared to the loss of production even for one day. A $200-$300 Seimen module that if failed and you do not have one and they are no longer available to buy new can cost over $100,000/day production losses (being conservative here) on the biggest line.

Exactly, when applied stupidly it spells disaster. Your talking about raw materials, big volume stuff, smaller items such as Car CPUs, which you know your going to use for instance for the next 2 years and have repair items do not take up much room and which none of your cars using it will function without it (critical item) -> STOCK. Plus evaluating your supply chains, their inventory allotments, manufacturers etc. It gets complicated where JIT can lead one very much astray. Standard items such as bearings, pumps that you can get quick and from various vendors -> don't stock. Proprietary items, hard to get, critical for operation, history of needing -> STOCK. Other items you routinely use and will not just sit on the shelf -> Stock. I bought a years worth of cam bearings for two lines that will be in operation for probably another 20 years. 1 year supply makes it very unlikely we will run out during the year, cheaper shipping cost (one time vice several), get a lower cost due to size (save money), save cost from inflation, stock once per year vice several, plus once you get in the habit of ordering small quantities of moving items, you end up with constantly ordering large number of different items vice just having to order a few items resulting in something running out -> shutting down for something totally stupid and preventable.That sound completely different than JIT, just in time from what I understand is the strategy that instead of having a giant warehouse with the land and staff for it, the would take place (or could change because you offer many options to the buyer of your product) entrants are received has needed, not the decision to have a backup or not for the tools and equipment used on a factory chain.

But anyway even if car company and everyone else would have held up big stock of chips (like Toyota did), the issue right now would still be here I think (like Toyota has by now, it just took more time), except if we are talking keeping more than 6 months of stock even if the demand explode with all that involve type of inventories.

It really depends on the item. My previous co-worker has a Uncle which works for Toyota, anyways Toyota would have the seats delivered when the vehicle was being made on the production line. These are the benefits for this:But anyway even if car company and everyone else would have held up big stock of chips (like Toyota did), the issue right now would still be here I think (like Toyota has by now, it just took more time), except if we are talking keeping more than 6 months of stock even if the demand explode with all that involve type of inventories.

- no need to store large items on site which can get complicated

- less handling damage and storage damage, less workers needed, less equipment needed to support

- items can be rejected upon receipt if damaged

- easy to have custom versions made faster

- Reliable vendor

- Can either store a given supply amount or manufacture item in a timely manner

- Has sufficient manufacturer supplies to make items as needed for Toyota for all configurations

- Good history and contract agreement

- Good communications when product is going to be needed, when ready by manufacturer/vendor and confirmation on when it will arrive on site

In our case our raw materials was plastic resin, less than a handful of different versions. Most came by rail car, some by truck. You don't tell the railroad when to come

Last edited:

Randall Stephens

[H]ard|Gawd

- Joined

- Mar 3, 2017

- Messages

- 1,820

Molly hauls minerals, we shoot bugs and mine...

Which highlights why certain fields (like the auto industry) really shouldn't be using the latest and greatest chips; they don't need that much performance, and the older foundries can keep producing older chips to satisfy demand.But anyway even if car company and everyone else would have held up big stock of chips (like Toyota did), the issue right now would still be here I think (like Toyota has by now, it just took more time), except if we are talking keeping more than 6 months of stock even if the demand explode with all that involve type of inventories.

Lets face it: As long as everyone chucks their iPhone status symbols every year or two, you are going to have demand side problems. Especially with the explosion you see in the demand for chips. And given the costs involved in making new foundries (even then, remember only ONE company manufactures the equipment you need for EUV, so there are still significant limitations on satisfying demand) it's unlikely we'll see supply pick up the slack anytime soon.

From what I understand, that what they did, most of the hundreds of chips in the auto industry were 200nm-300nm type of very old and the Testla and other that did the exact opposite on 7nm did much better, because investing in old tech foundries has not been popularWhich highlights why certain fields (like the auto industry) really shouldn't be using the latest and greatest chips; they don't need that much performance, and the older foundries can keep producing older chips to satisfy demand.

Investing in, no. But they still exist and still pump out a surprising amount of silicon. Granted, they should probably be on something a bit more modern (90/45nm), but certainly should stay away from the bleeding edge (due to cost/availability).From what I understand, that what they did, most of the hundreds of chips in the auto industry were 200nm-300nm type of very old and the Testla and other that did the exact opposite on 7nm did much better, because investing in old tech foundries has not been popular

Again, the main problem is an explosion of demand, combined with the lack of a way to quickly increase supply.

And the older, large feature chips may be more resistant to environmental extremes like heat and cold, extreme dryness or high humidity, vibration, etc.Investing in, no. But they still exist and still pump out a surprising amount of silicon. Granted, they should probably be on something a bit more modern (90/45nm), but certainly should stay away from the bleeding edge (due to cost/availability).

Again, the main problem is an explosion of demand, combined with the lack of a way to quickly increase supply.

But again from my understanding the car chips issue is on very old tech not the new one:

https://www.motorbiscuit.com/tesla-avoid-chip-shortage/

https://www.autoevolution.com/news/...he-chip-shortage-more-efficiently-170762.html

One approach that few carmakers seem to be exploring because of obvious reasons is investing in a modern chip design. Carmakers are still sticking with old chip platforms that remain in high demand right now (in fact, foundries have already moved to a new design and don’t want to expand old design capacity because it’d only be a short-term investment), as migrating to a new platform requires additional spending, especially in the testing phase, just to make sure everything is running properly.

On the other hand, Tesla is the living proof that redesigned electronics using a new-generation chip architecture is the right way to go, especially as the supply in this market isn’t by any means short, and turning to production shutdowns isn’t thus required.

https://www.motorbiscuit.com/tesla-avoid-chip-shortage/

https://www.autoevolution.com/news/...he-chip-shortage-more-efficiently-170762.html

One approach that few carmakers seem to be exploring because of obvious reasons is investing in a modern chip design. Carmakers are still sticking with old chip platforms that remain in high demand right now (in fact, foundries have already moved to a new design and don’t want to expand old design capacity because it’d only be a short-term investment), as migrating to a new platform requires additional spending, especially in the testing phase, just to make sure everything is running properly.

On the other hand, Tesla is the living proof that redesigned electronics using a new-generation chip architecture is the right way to go, especially as the supply in this market isn’t by any means short, and turning to production shutdowns isn’t thus required.

learners permit

[H]ard|Gawd

- Joined

- Jun 15, 2005

- Messages

- 1,806

Global foundries is partnering with Ford to bring some automotive relief at least. Why doesn't this list include all domestic automakers since glofo already has the process capabilities to deliver the capacity of chips needed in the correct node for vehicles. Sometimes I wonder wth are these asshats in charge of the auto industry are thinking. It's been a year since they've known the shit was gonna hit the fan.

Historically the US auto industry has made some very, very bad decisions. Like ignoring the sales of foreign economy cars in the 70s, until after VW and various Japanese automakers established a strong market position. Like having poor esthetics on their cars. Etc. Like letting Pontiac and Oldsmobile brands die because all GM brands (except maybe Cadillac) shared the same body styles. Big exception was Cadillac repositioning itself from an "old people's car" to a stylish brand for younger buyers.Global foundries is partnering with Ford to bring some automotive relief at least. Why doesn't this list include all domestic automakers since glofo already has the process capabilities to deliver the capacity of chips needed in the correct node for vehicles. Sometimes I wonder wth are these asshats in charge of the auto industry are thinking. It's been a year since they've known the shit was gonna hit the fan.

learners permit

[H]ard|Gawd

- Joined

- Jun 15, 2005

- Messages

- 1,806

Late 70's to late 80's were the epitomy of ignorance for US auto industry. Lack of reinvestment for updated machine tools and moving skilled manufacturing jobs to states without strong union ties to lower wages and satisfy greedy CEOs and bean counters just about handed the entire industry to foreign manufacturing. Growing up in Michigan and watching the local economies crumble during these events definetely left the impression of mismanagement on me. Then they all get in line for government handouts while claiming to not understand what happened is just the way it's done apparently. No wonder at all why most of the world thinks the US is a failed experiment in self governance.

pippenainteasy

[H]ard|Gawd

- Joined

- May 20, 2016

- Messages

- 1,158

40% of American assets (real estate, businesses, etc) are owned by foreigners now. This was less than 10% prior to the 1980s, back when the US was running a trade surplus. Now we are running $1 trillion a year trade deficits. Pretty soon everything in this country will be owned by foreigners and we'll be a 3rd world country that developed economies send their goods to and we just dig stuff out of the ground and send them the raw materials to work with.

That sound really high considering how little of the housing market that is foreign own and how large ot the Americans asset it is:40% of American assets (real estate, businesses, etc) are owned by foreigners now.

https://www.federalreserve.gov/releases/z1/dataviz/z1/balance_sheet/table/

- Joined

- May 18, 1997

- Messages

- 55,634

I will share something with you that is not common knowledge, but I know for a fact to be true. The "big" auto makers cancelled huge POs for ICs at the onset of COVID. Other industries pushed into that vacuum and picked up those inventories. The auto companies simply made the wrong call when COVID started, tremendously upset their "partners," and lost favor with those companies. You dance with who brung you, just like your momma told you. I guess big auto did not think that pertained to them.Sometimes I wonder wth are these asshats in charge of the auto industry are thinking. It's been a year since they've known the shit was gonna hit the fan.

I will share something with you that is not common knowledge, but I know for a fact to be true. The "big" auto makers cancelled huge POs for ICs at the onset of COVID.

That was talked about a bit everywhere I think, it did surprise everyone how short the lower demand for cars was and how fast the recovery got:

https://www.caranddriver.com/news/a36519857/chip-shortage-aut-production-cuts/

When factories were shuttered and new-car sales cratered in the United States in the early days of the coronavirus pandemic last spring, many carmakers made what has turned out to be a critical error: they canceled orders for the microchips that have become essential to the manufacture and operation of new cars. But as demand for new cars has returned, carmakers have struggled to source the chips they need to complete their cars

https://ihsmarkit.com/research-anal...r-supply-constraints-expected-to-resolve.html ( 23 December 2020)

The auto industry's recovery in the third and fourth quarters of 2020 has begun to put some signs of stress on the supply chain. In one example, IHS Markit estimates that the demand for semiconductors across other industries in the final quarter of 2020 increased at a stronger-than-expected rate. The increase in production of new smartphones leveraging 5G capabilities and the recent introduction of new gaming platforms, including Sony's PlayStation 5 and Microsoft's Xbox Series X, resulted in these segments consuming the front-end capacity available due to earlier cancelations by automotive manufacturers while demand was low and the prospects for recovery were unknown. Adding to it, with Christmas and Chinese New Year coming up, spare capacity is in short supply, especially at the external foundries.

- Joined

- May 18, 1997

- Messages

- 55,634

Guess I need to read more rather than talk to industry people.That was talked about a bit everywhere I think, it did surprise everyone how short the lower demand for cars was and how fast the recovery got:

https://www.caranddriver.com/news/a36519857/chip-shortage-aut-production-cuts/

When factories were shuttered and new-car sales cratered in the United States in the early days of the coronavirus pandemic last spring, many carmakers made what has turned out to be a critical error: they canceled orders for the microchips that have become essential to the manufacture and operation of new cars. But as demand for new cars has returned, carmakers have struggled to source the chips they need to complete their cars

https://ihsmarkit.com/research-anal...r-supply-constraints-expected-to-resolve.html ( 23 December 2020)

The auto industry's recovery in the third and fourth quarters of 2020 has begun to put some signs of stress on the supply chain. In one example, IHS Markit estimates that the demand for semiconductors across other industries in the final quarter of 2020 increased at a stronger-than-expected rate. The increase in production of new smartphones leveraging 5G capabilities and the recent introduction of new gaming platforms, including Sony's PlayStation 5 and Microsoft's Xbox Series X, resulted in these segments consuming the front-end capacity available due to earlier cancelations by automotive manufacturers while demand was low and the prospects for recovery were unknown. Adding to it, with Christmas and Chinese New Year coming up, spare capacity is in short supply, especially at the external foundries.

Kiriakos-GR

Weaksauce

- Joined

- Nov 21, 2021

- Messages

- 99

I think that arstechnica this is now bunch of computer nerds playing cheap games with people minds.

There is not any chip shortages.

Production is up and running to catch up cars industry which was left behind.

Within 2022 new factory this is getting ready in Germany and a second in the USA.

There is not any chip shortages.

Production is up and running to catch up cars industry which was left behind.

Within 2022 new factory this is getting ready in Germany and a second in the USA.

There is not any chip shortages.

Why I cannot buy a PS5 online then if there is not a situation in which something cannot be obtained in sufficient amount ? Why there is anything to catch up ? Why new factory has any relevance ?

The world making more chips than ever before does not mean there is no shortages if demand is even higher than that.

Last edited:

![[H]ard|Forum](/styles/hardforum/xenforo/logo_dark.png)