Happy Hopping

Supreme [H]ardness

- Joined

- Jul 1, 2004

- Messages

- 7,837

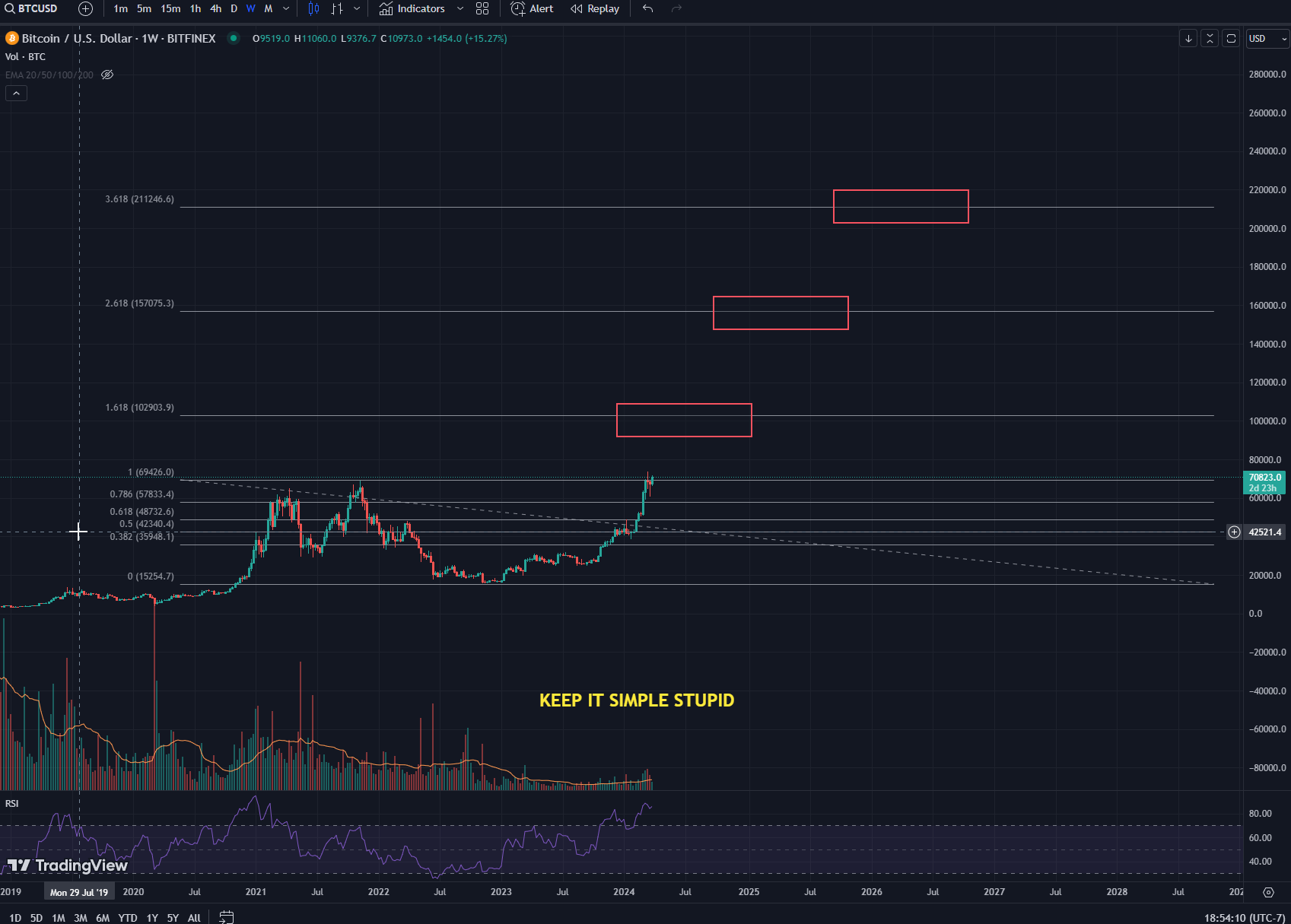

but as you read from those 2 links, they are also using 10% as a label for crypto correction territory. So don't kill the messager , write them a letter. Whether you want to classify bitcoin as a commodity, or called Crypto category, it changes nothing. The Market maker is still using 10% as in correction category.

Further, their entire portfolio is based on a Fibonacci grid, so once it falls off a certain layer of grid, program selling automatically takes off, in this case, 10%. Just work out the ratio of 1.618% yourself.

https://en.wikipedia.org/wiki/Fibonacci_sequence

if you use software such as Medved Trader, he automatically draw the fibonacci grid for you

Further, their entire portfolio is based on a Fibonacci grid, so once it falls off a certain layer of grid, program selling automatically takes off, in this case, 10%. Just work out the ratio of 1.618% yourself.

https://en.wikipedia.org/wiki/Fibonacci_sequence

if you use software such as Medved Trader, he automatically draw the fibonacci grid for you

![[H]ard|Forum](/styles/hardforum/xenforo/logo_dark.png)