Rev. Night

[H]ard|Gawd

- Joined

- Mar 30, 2004

- Messages

- 1,493

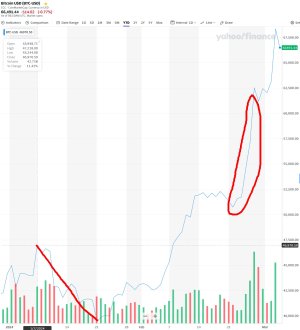

BTC is at an all time high right now, thats why I just sold. Several articles said that after the halving, the new price should be in the $40s. Invest then?

Whats peoples general impression of BTC right now?

Whats peoples general impression of BTC right now?

![[H]ard|Forum](/styles/hardforum/xenforo/logo_dark.png)