erek

[H]F Junkie

- Joined

- Dec 19, 2005

- Messages

- 10,871

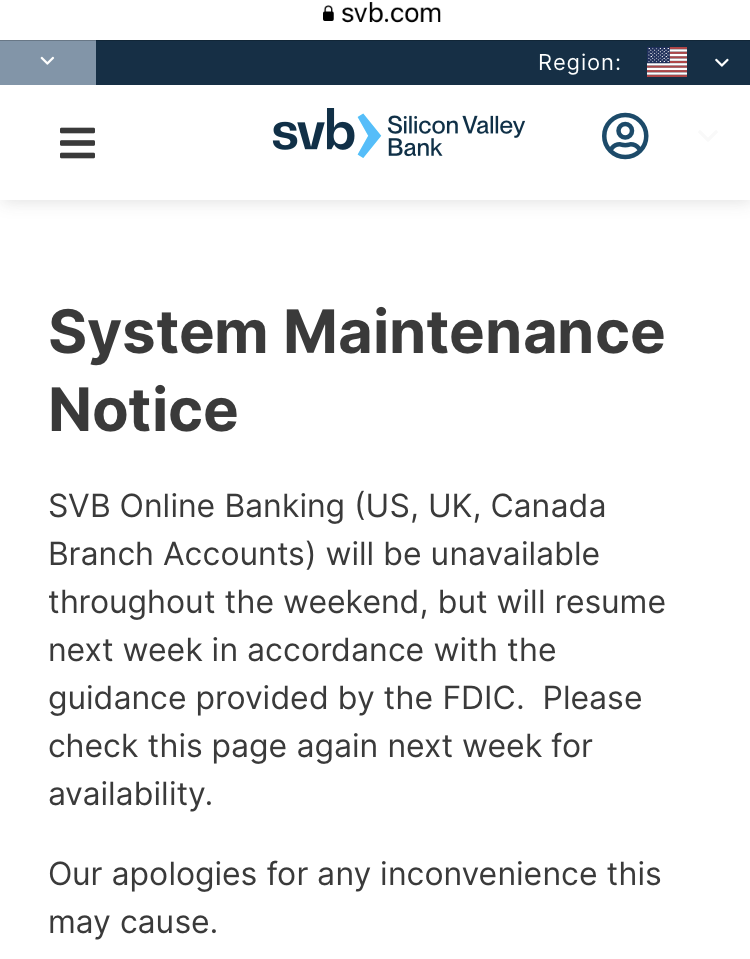

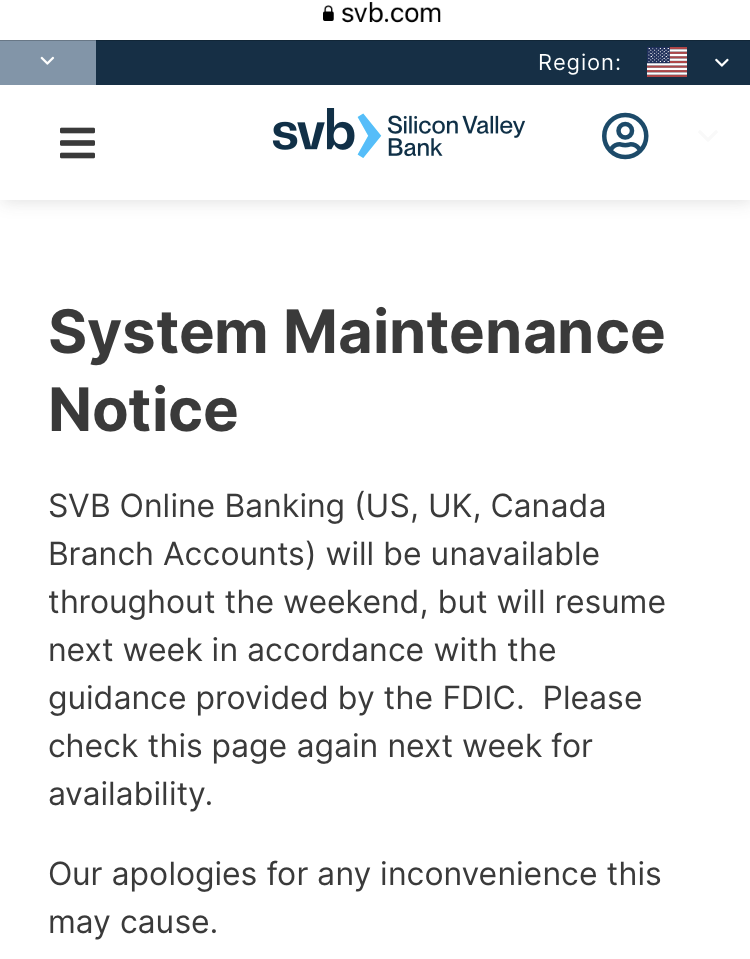

Big Impact on Big Tech and Start Ups

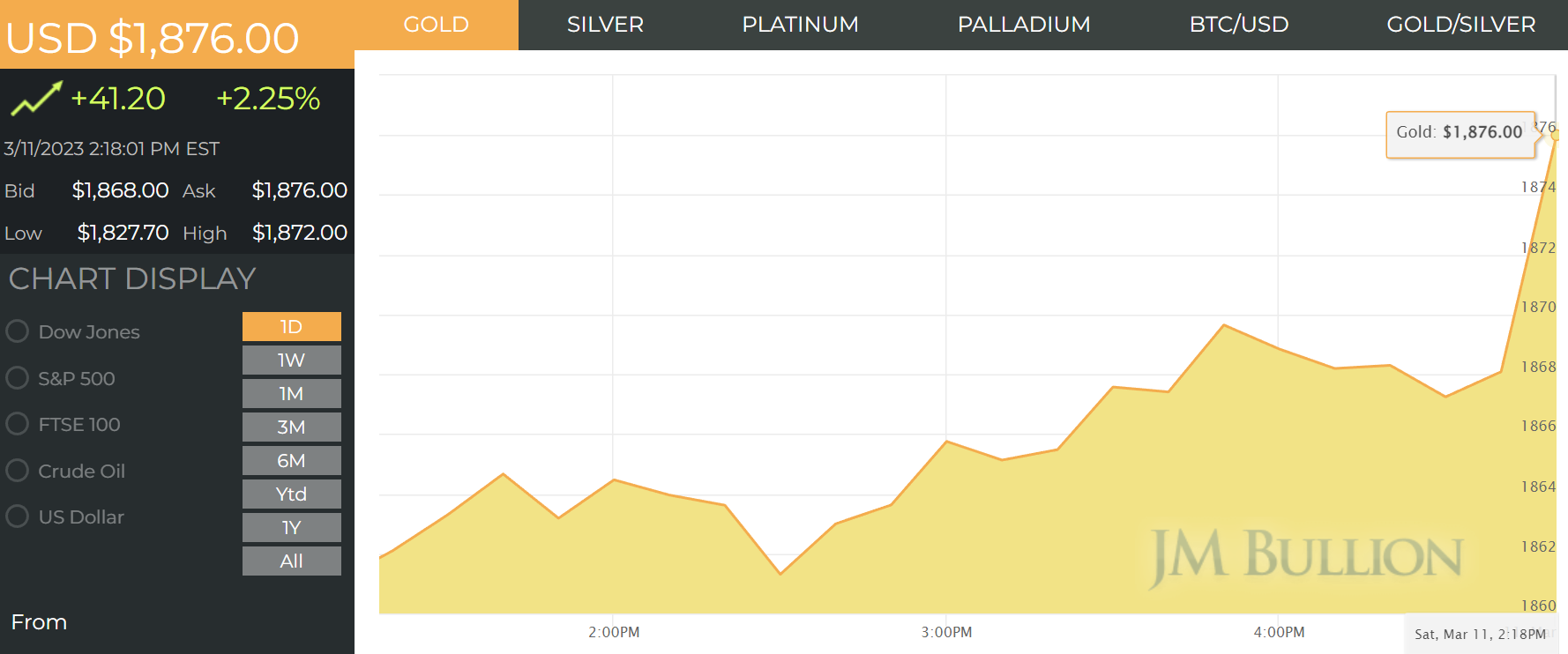

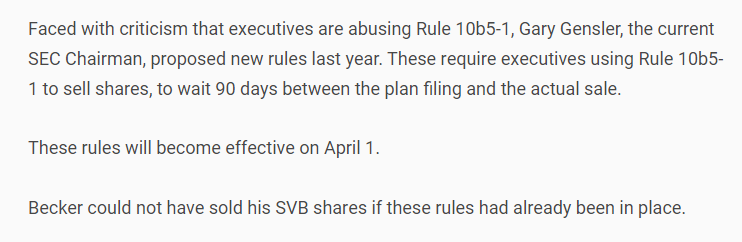

“It remains to be seen how many more companies will be affected by the collapse of Silicon Valley Bank. News outlets are today reporting that Roblox Corporation, Rocket Lab and Vice Media are SVB customers. Financial analysts are keeping an eye on the resulting fallout, and predictions have been posited regarding the fragile status of certain banking groups. The US Federal Reserve, as well as other international central banks, have sharply raised interest rates and borrowing costs in attempts to dampen the effects of inflation. This has had a knock-on effect on the bond market - portfolios decline in value as interest rates rise.”

Source: https://www.techpowerup.com/305778/...ch-industry-roku-divulges-its-svb-investments

“It remains to be seen how many more companies will be affected by the collapse of Silicon Valley Bank. News outlets are today reporting that Roblox Corporation, Rocket Lab and Vice Media are SVB customers. Financial analysts are keeping an eye on the resulting fallout, and predictions have been posited regarding the fragile status of certain banking groups. The US Federal Reserve, as well as other international central banks, have sharply raised interest rates and borrowing costs in attempts to dampen the effects of inflation. This has had a knock-on effect on the bond market - portfolios decline in value as interest rates rise.”

Source: https://www.techpowerup.com/305778/...ch-industry-roku-divulges-its-svb-investments

Last edited:

![[H]ard|Forum](/styles/hardforum/xenforo/logo_dark.png)