Mchart

Supreme [H]ardness

- Joined

- Aug 7, 2004

- Messages

- 6,552

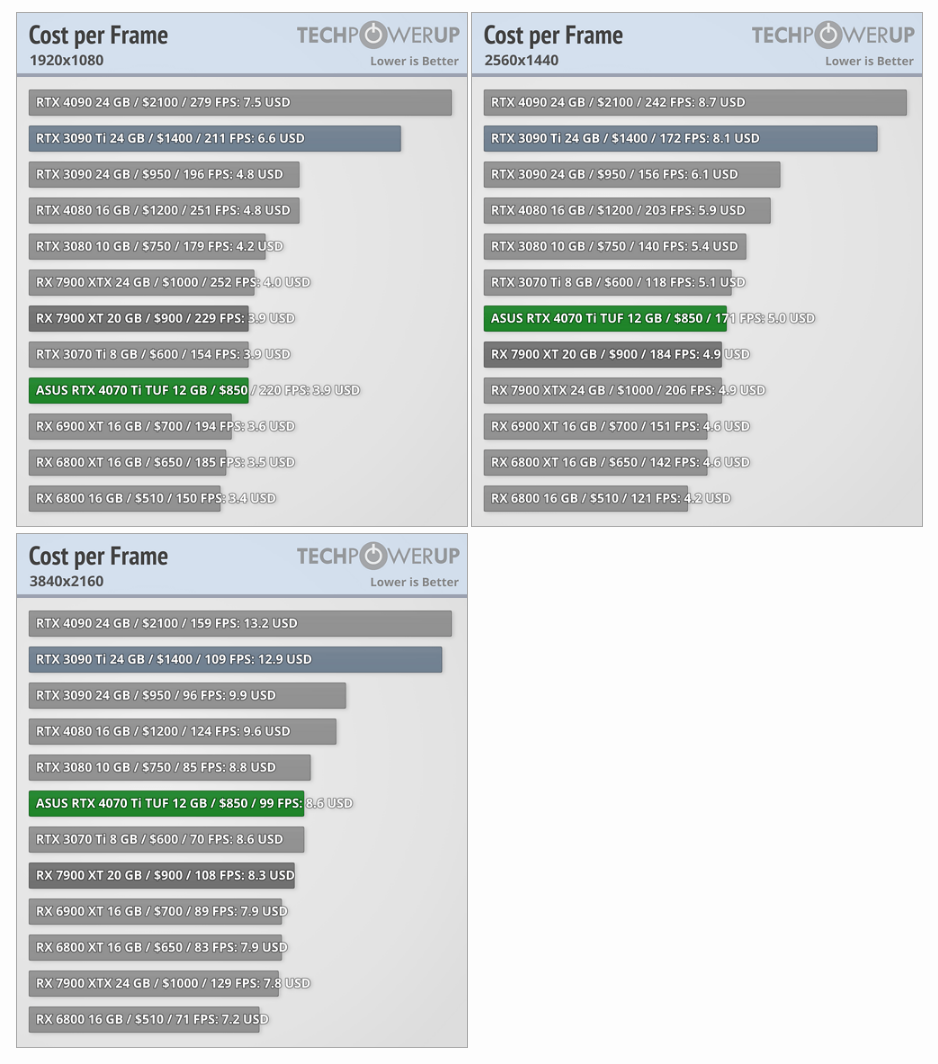

To me the 4090 'value' is a joke - Mostly because it's impossible for an average person to get one, even if you remove the $1600 barrier of entry. Many could possibly afford it, but because of it's position it's being scalped just like the 30 series cards were.

Also, most of us could never get a 30 series anywhere near normal MSRP. That was a joke. A 3080 was closer to $1k for most people, a 3080ti closer to $1400 for most people, and a 3090 closer to $1600 for most people.

I've said it before, but at least both the 4080 and now 4070ti are largely available. You can actually walk into a store and buy one. So a 4070ti for $850 isn't that bad considering the 30 series cards were impossible to get at their MSRP anyways (If you could even get one, everyone I knew in real life with these cards got them in pre-built systems)

Doesn't make the pricing 'correct' - But all of these reviews I see completely fail to account for actual availability to a consumer. Hailing the 3080 as the next coming of Christ because of it's 'awesome' pricing completely overlooks the fact that most didn't get the damn things at that pricing.

The only real outlier here to me as of right now, is still the 4080 pricing. It's just not worth the $1200 base pricing, althoug it seems nvidia is going to be stuck with that pricing since AIB's have no room to make any money off the 4070ti pricing structure.

Also, most of us could never get a 30 series anywhere near normal MSRP. That was a joke. A 3080 was closer to $1k for most people, a 3080ti closer to $1400 for most people, and a 3090 closer to $1600 for most people.

I've said it before, but at least both the 4080 and now 4070ti are largely available. You can actually walk into a store and buy one. So a 4070ti for $850 isn't that bad considering the 30 series cards were impossible to get at their MSRP anyways (If you could even get one, everyone I knew in real life with these cards got them in pre-built systems)

Doesn't make the pricing 'correct' - But all of these reviews I see completely fail to account for actual availability to a consumer. Hailing the 3080 as the next coming of Christ because of it's 'awesome' pricing completely overlooks the fact that most didn't get the damn things at that pricing.

The only real outlier here to me as of right now, is still the 4080 pricing. It's just not worth the $1200 base pricing, althoug it seems nvidia is going to be stuck with that pricing since AIB's have no room to make any money off the 4070ti pricing structure.

Last edited:

![[H]ard|Forum](/styles/hardforum/xenforo/logo_dark.png)