erek

[H]F Junkie

- Joined

- Dec 19, 2005

- Messages

- 10,875

Hmm

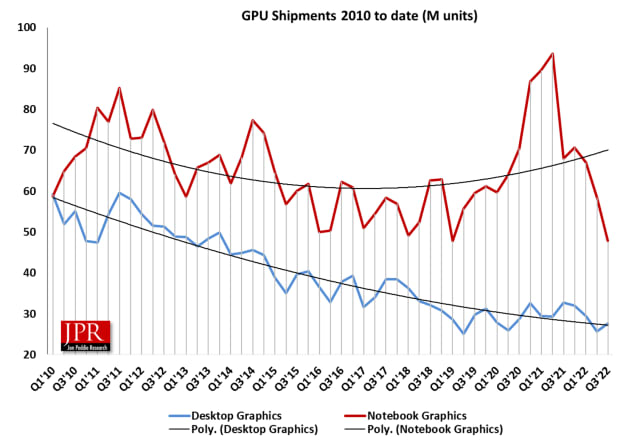

"GPUs have been a leading indicator of the market because a GPU goes into a system before the suppliers ship the PC. Most of the semiconductor vendors are guiding down for the next quarter, an average of -6.44%. Last quarter, they guided an average of -0.21%, which was too high.

Jon Peddie, president of JPR, noted, "This quarter's total graphics processor shipments (integrated/embedded and discrete) decreased an astounding -15.3% from the previous quarter, contributing to a decline in the historical 10-year average rate of 6.8%. A total of 64 million units were shipped in the quarter, which was a decrease of -38.5 million units from the same quarter a year ago, indicating the GPU market is negative on a year-to-year basis.

"The sky may be dark right now, but I promise you, it is not failing (except in Northern California, where the rain still hasn't let up, which means we're going to have the most beautiful spring)," Peddie said.

JPR also publishes a series of reports on the graphics add-in board market and PC gaming hardware market, which covers the total market, including systems and accessories, and looks at 31 countries."

Source: https://www.techpowerup.com/305279/...ntially-from-last-quarter-and-38-year-to-year

"GPUs have been a leading indicator of the market because a GPU goes into a system before the suppliers ship the PC. Most of the semiconductor vendors are guiding down for the next quarter, an average of -6.44%. Last quarter, they guided an average of -0.21%, which was too high.

Jon Peddie, president of JPR, noted, "This quarter's total graphics processor shipments (integrated/embedded and discrete) decreased an astounding -15.3% from the previous quarter, contributing to a decline in the historical 10-year average rate of 6.8%. A total of 64 million units were shipped in the quarter, which was a decrease of -38.5 million units from the same quarter a year ago, indicating the GPU market is negative on a year-to-year basis.

"The sky may be dark right now, but I promise you, it is not failing (except in Northern California, where the rain still hasn't let up, which means we're going to have the most beautiful spring)," Peddie said.

JPR also publishes a series of reports on the graphics add-in board market and PC gaming hardware market, which covers the total market, including systems and accessories, and looks at 31 countries."

Source: https://www.techpowerup.com/305279/...ntially-from-last-quarter-and-38-year-to-year

![[H]ard|Forum](/styles/hardforum/xenforo/logo_dark.png)