"free transactions" are not really free. Just because the customer is not charged for it doesn't mean that the brokerage company made nothing. Robinhood has made a fortune off of this fact. Getting down to it - most all major brokerages do not charge fees. To do so puts you out of competition with everyone else.Yes, but it feel like it would help a company that offer free transaction to their customer but have to pay for them, to block them, it does not require any other motivation for them to do this than to want to stop to bleed of their own money.

If normal fee transaction platform do not block them, we will have our answer I think.

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

GameStop Stock keeps going up no end in sight

- Thread starter Comixbooks

- Start date

Robinhood make money on their customer sleeping cash balance, selling customer information, interest on margin lending or this strange thing that sound like should be illegal:"free transactions" are not really free. Just because the customer is no charged for it doesn't mean that the brokerage company made nothing. Robinhood has made a fortune off of this fact.

https://en.wikipedia.org/wiki/Payment_for_order_flow

All of this would not apply here on millions of people buying small amount of stock on new account with a 0 commissions.

"sound like" LoL. The fact of the matter is all corps make a ton of money off of profiling their customers. It's NOT illegal. ie see Fakebook, Apple, Google, even MS nowadays. You ought to know by now opening an account with anything means you are profiled. If you don't like it - don't register.Robinhood make money on their customer sleeping cash balance, selling customer information, interest on margin lending or this strange thing that sound like should be illegal:

https://en.wikipedia.org/wiki/Payment_for_order_flow

All of this would not apply here on millions of people buying small amount of stock on new account with a 0 commissions.

That not profiling that routing order over a third party paying the broker for doing it."sound like" LoL. The fact of the matter is all corps make a ton of money off of profiling their customers. It's NOT illegal. ie see Fakebook, Apple, Google, even MS nowadays. You ought to know by now opening an account with anything means you are profiled. If you don't like it - don't register.

Regardless, that was not the point, I doubt any of those revenues that make free transaction model work, would apply to the current craze they put breaks on.

MavericK

Zero Cool

- Joined

- Sep 2, 2004

- Messages

- 31,890

Class action lawsuit against Robinhood has been filed.

https://twitter.com/LJMoynihan/status/1354836830169006081

https://twitter.com/LJMoynihan/status/1354836830169006081

Lawmakers are bashing Robinhood over its GameStop trading freeze

Finally some common sense.

Feel like they are putting a more dramatic spin to it:Lawmakers are bashing Robinhood over its GameStop trading freeze

Finally some common sense.

“While retail trading in some cases, like on Robinhood, blocked the purchasing of GameStop, hedge funds were still allowed to trade the stock,” Khanna said.

I and everyone else was still allowed to trade the stock, just not on Robinhood (or other zero commission platform).

This whole gamestop thing is the little man showing the big man (wallstreet). You cant fuck with us and we know youre corrupt as fuck in your ivory towers. This is something else right now. This is not a trend to jump on, its purely a political ground swell. Unless youre protesting big corpo sons of b's id steer clear of this time bomb.

MavericK

Zero Cool

- Joined

- Sep 2, 2004

- Messages

- 31,890

It's not really even political (at this point), it's class warfare and the proletariat rising up.This whole gamestop thing is the little man showing the big man (wallstreet). You cant fuck with us and we know youre corrupt as fuck in your ivory towers. This is something else right now. This is not a trend to jump on, its purely a political ground swell. Unless youre protesting big corpo sons of b's id steer clear of this time bomb.

Reading tweets with screenshots alleging Robinhood were automatically selling stocks without users' consent.

https://twitter.com/555Sunny/status/1354854993946406917#m

https://twitter.com/555Sunny/status/1354854993946406917#m

This seem a good attitude for someone to jump in, to make money it a giant risk (just thing someone that bought a lot of Gamestop over $490), that said I am not fully how wallstreet was fucking the little man in the current examples.This whole gamestop thing is the little man showing the big man (wallstreet). You cant fuck with us and we know youre corrupt as fuck in your ivory towers. This is something else right now. This is not a trend to jump on, its purely a political ground swell. Unless youre protesting big corpo sons of b's id steer clear of this time bomb.

Users using margin or bought cash ?Reading tweets with screenshots alleging Robinhood were automatically selling stocks without users' consent.

https://twitter.com/555Sunny/status/1354854993946406917#m

Pretty simple, if you are blocked - move to another platform. You seem dramatic putting spin on that.Feel like they are putting a more dramatic spin to it:

“While retail trading in some cases, like on Robinhood, blocked the purchasing of GameStop, hedge funds were still allowed to trade the stock,” Khanna said.

I and everyone else was still allowed to trade the stock, just not on Robinhood (or other zero commission platform).

I feel like I must be really unclear, you just repeated exactly what I said.Pretty simple, if you are blocked - move to another platform. You seem dramatic putting spin on that.

you're welcome for the translation i guessI feel like I must be really unclear, you just repeated exactly what I said.

Idk. There's a tweet chain that follows wondering the same thing.Users using margin or bought cash ?

I mean how different is:you're welcome for the translation i guess

I and everyone else was still allowed to trade the stock, just not on Robinhood (or other zero commission platform).

to your:

Pretty simple, if you are blocked - move to another platform.

Could simply be way to much margin to a very volatile affair (going down) that triggers auto-sales, and they are using the eyes and click of people that do not know much but have a sudden interest.Idk. There's a tweet chain that follows wondering the same thing.

zero commission fidelity works fine for one. That's different.I mean how different is:

I and everyone else was still allowed to trade the stock, just not on Robinhood (or other zero commission platform).

to your:

Pretty simple, if you are blocked - move to another platform.

Add the other zero commission that put a break on those that was implied here (because Robinhood was not alone in this TD and another big one did the same), come-on now.zero commission fidelity works fine for one. That's different.

so now i have to prove your side via converse proof as well? LoL nope. Do your own homework.Add the other zero commission that put a break on those that was implied here (because Robinhood was not alone in this TD and another big one did the same), come-on now.

Come-on, you are not making much sense and you fully know it:so now i have to prove your side via converse proof as well? LoL nope. Do your own fkn homework.

An article say:

“While retail trading in some cases, like on Robinhood, blocked the purchasing of GameStop, hedge funds were still allowed to trade the stock,” Khanna said.

To which I respond:

That feel like a dramatic spin, I and everyone else was still allowed to trade the stock, just not on Robinhood (or other zero commission platform).

You responded to my comment:

Pretty simple, if you are blocked - move to another platform. You seem dramatic putting spin on that.

How does that make sense ?

What homework are you talking about ? Or prove of anything ?

I mean how different is:

I and everyone else was still allowed to trade the stock, just not on Robinhood (or other zero commission platform).

to your:

Pretty simple, if you are blocked - move to another platform.

Proof of not being blocked on a trade? Sorry, not every broker acts like robinhood. they are a cheap shit broker. Fidelity is ZERO COMMISSION so by allowing trading on gamestop - your assumptions are not true. WTF?Come-on, you are not making much sense and you fully know it:

An article say:

“While retail trading in some cases, like on Robinhood, blocked the purchasing of GameStop, hedge funds were still allowed to trade the stock,” Khanna said.

To which I respond:

That feel like a dramatic spin, I and everyone else was still allowed to trade the stock, just not on Robinhood (or other zero commission platform).

You responded to my comment:

Pretty simple, if you are blocked - move to another platform. You seem dramatic putting spin on that.

How does that make sense ?

What homework are you talking about ? Or prove of anything ?

The sentence was not about all zero commision traders blocked the trade.Proof of not being blocked on a trade? Sorry, not every broker acts like robinhood. they are a cheap shit broker. Fidelity is ZERO COMMISSION so by allowing trading on gamestop - your assumptions are not true. WTF?

I was saying that everyone could still trade just not on robinhood and some other zero commission platform that also blocked the purchase. My point was not every brocker acts like Robinhood.

How the beginning of my sentence: I and everyone else was still allowed to trade the stock, work with any notion and that I am implying that all traders blocked the purchase of the stock ?

Jesus Christ dude, Hire a translator.The sentence was not about all zero commision traders blocked the trade.

I was saying that everyone could still trade just not on robinhood and some other zero commission platform that also blocked the purchase. My point was not every brocker acts like Robinhood.

How the beginning of my sentence: I and everyone else was still allowed to trade the stock, work with any notion and that I am implying that all traders blocked the purchase of the stock ?

DeathSmasher

Gawd

- Joined

- Apr 14, 2006

- Messages

- 575

Can someone turn the GPU scalpers onto this new way of making a quick buck so i can find a GPU at MSRP please!

sfsuphysics

[H]F Junkie

- Joined

- Jan 14, 2007

- Messages

- 15,991

I'm not saying anything about buying stocks on margin, I'm talking about short selling more stocks than what exist.You can't just eliminate buying stock on margin just because you don't like it. Credit is at the heart of this nation's (and almost all other) financial market and everything would cease to function without it. Don't make an example of stocks because it's everywhere from you wallet to the federal deficit.

Yes I get that, it's one of the factors that destroyed the economy in 1929, now the federal reserve puts a limit on how much you can borrow on margin, but that's not the point here because apparently there is no limit on borrowing stocks for short selling, by the fact that they "borrowed" 120% of the stocks... meaning they borrowed more stocks than what exist. And this is the kind of behavior that needs to be regulated.Buying what you don't have is practically the definition of what margin is.

Because it is "for once" as you saidI see what you mean, but I believe she is double talking and playing both sides of the fence. Why call for regulation when it's the little guy winning for once? Wether you're organized under Reddit or organized under a Hedge Fund - go ahead and short or buy. At least that's my theory.

For once somebdoy crossed the street safely is neither an argument for not making changes. So we call for regulation on streets (better lighting proper traffic signals etc). using the current attention it might be easier than it was before because "nobody cared" .

Who's lending more than they have?I think one point you're forgetting is you shouldn't be able lend more than you have, which is the case here with 120% of the available stock being "borrowed" which doesn't make it a borrowed thing, it makes it selling something you do not have, which it boggles my mind why this is even allowed.

If I borrow a share from you; you had the share, and lent it and it's fine. I promise I'll give you an equivalent share whenever, and pay you for the privilege and put up collateral to make you whole in case I don't give you a share as promised.

While I'm holding the share, I can sell it; why not, I have the share, and can do whatever with it, as long as I fulfill my promise to you.

Whoever buys it owns the share outright. And can sell it or lend it. If I borrow it from them, I can do it again etc.

At every step, a lender owned the share, and a seller had the rights to sell it, and a buyer bought a real share. (yes, naked short selling is a thing, but it's generally prohibited with some minor exceptions, and isn't a factor in the overall experience).

It's kind of weird that more shares were borrowed than exist, but the same thing happens with dollars, and we're generally OK with that. If I borrow $10 from you for lunch, you wouldn't be upset if I also borrowed $10 from the lunch restaurant to pay for dinner. I'd owe $20, and there was only ever $10 in the system; but when I get paid, I'll pay you and the lunch restaurant back.

Adding: You could maybe want a borrowed share to be marked, so that a borrowed share can't be relent. But then you'd need to trade borrowed shares different than normal shares; because I'm not paying the same $ for a share I can't lend as one I can lend. More than 100% short interest isn't really a big deal; unsophisticated investors shouldn't be selling short, or writing uncovered calls, or any of the types of things that have unlimited losses baked into them; big pocket investors shouldn't be overshorting stocks, because if they do, they're liable to get squeezed and nobody will wipe up their tears (except for maybe the trade stoppage this morning). Even with the trade stoppage, the shorts got pretty screwed, and they're likely to be more careful next time.

Last edited:

sfsuphysics

[H]F Junkie

- Joined

- Jan 14, 2007

- Messages

- 15,991

Who's lending more than they have?

If I borrow a share from you; you had the share, and lent it and it's fine. I promise I'll give you an equivalent share whenever, and pay you for the privilege and put up collateral to make you whole in case I don't give you a share as promised.

While I'm holding the share, I can sell it; why not, I have the share, and can do whatever with it, as long as I fulfill my promise to you.

Whoever buys it owns the share outright. And can sell it or lend it. If I borrow it from them, I can do it again etc.

That last part is the sketchy part, you "borrowed" a stock, and re-lend it, you effectively doubled the borrowing of a single stock. And yeah you mention it in your post, but these should not be able to be re-lent. This is what basically allowed 140% of available shares being shorted. I just see some pretty large parallels between allowing stuff like this to happen, and what happened with the housing crisis of taking crappy loans and creating a better loan by combining the crappy ones.

DTN107

Supreme [H]ardness

- Joined

- Jun 30, 2008

- Messages

- 4,846

Got my diamond hands activated on GME and AMC.

GoodBoy

2[H]4U

- Joined

- Nov 29, 2004

- Messages

- 2,745

Hedgefunds that got bit by this, did it to themselves. Better not be any bailout. They can eat it.

Nobu

[H]F Junkie

- Joined

- Jun 7, 2007

- Messages

- 10,024

This is a dramatization I found of a first hand account of what happened in the boardroom of the company who shorted gme, a source says:

Ahh...a classic. I knew someone had to have made one by now.

Ahh...a classic. I knew someone had to have made one by now.

Youn

Supreme [H]ardness

- Joined

- Jan 22, 2007

- Messages

- 5,973

I dunno guys, I just visited my Robinhood account and was able to buy Gamestop... did they reverse their decision that quickly? Seems like earlier in the day it was completely disabled.

sfsuphysics

[H]F Junkie

- Joined

- Jan 14, 2007

- Messages

- 15,991

Maybe because of the class action lawsuit set against them, that they're not looking out for the best interests of their customers but instead by a billionaire hedge fund who owns part of it?I dunno guys, I just visited my Robinhood account and was able to buy Gamestop... did they reverse their decision that quickly? Seems like earlier in the day it was completely disabled.

I might have to change my handle after Friday/Monday. Normally I’m a patient investor, but the naked short was too good to pass up. GME is going to  big when the shorts expire. AMC is on deck and there is so much activity already, and still at a low price, that it could be bigger than GME because many only heard about GME after it was out of reach. I have a hunch that AMC will be the ground war to GME’s shot across the bow.

big when the shorts expire. AMC is on deck and there is so much activity already, and still at a low price, that it could be bigger than GME because many only heard about GME after it was out of reach. I have a hunch that AMC will be the ground war to GME’s shot across the bow.

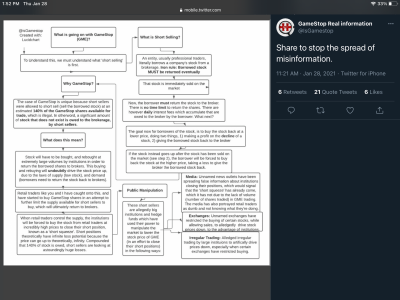

There is one potential monkey wrench and it’s a big one - liquidity. CEO of Interactive Brokers explained why they pre-emptively shut down trading of GME, AMC, etc. and it had to do with the whole system not having enough to cover and process the losses fast enough. Idk how accurate he was being, but if GME doesn’t tank the system, after a longer slog, AMC might. It‘s likely been explained already, but here’s a pic describing the gist of it all:

There is one potential monkey wrench and it’s a big one - liquidity. CEO of Interactive Brokers explained why they pre-emptively shut down trading of GME, AMC, etc. and it had to do with the whole system not having enough to cover and process the losses fast enough. Idk how accurate he was being, but if GME doesn’t tank the system, after a longer slog, AMC might. It‘s likely been explained already, but here’s a pic describing the gist of it all:

Attachments

KazeoHin

[H]F Junkie

- Joined

- Sep 7, 2011

- Messages

- 9,000

GME is still shorted as all fuck, it's absurd

Hold strong lads, Valhalla awaits

I've never traded stock in my life, but this makes me want to spin up an account and start guying up GME.

Forreal, be weary. It's violently in the danger zone - this is nowhere near a sane scenario.I've never traded stock in my life, but this makes me want to spin up an account and start guying up GME.

The (still) ridiculous short float makes it seem likely there's still squeeze ahead. Presumably cataclysmic.

Unfortunately I wasn't enough of an maniac to diamond hand a millionaire-maker level of position. I was close as hell to buying in at $20 but bitched out.

![[H]ard|Forum](/styles/hardforum/xenforo/logo_dark.png)