KazeoHin

[H]F Junkie

- Joined

- Sep 7, 2011

- Messages

- 9,000

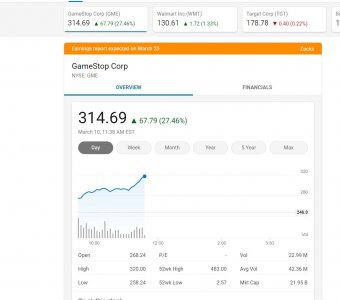

This is crazy, it's trading up on news the appointed the chewy guy to be over their e-comm site? WTF exactly are they gonna sell online? This guy should have been there in 2005. This is a failing company. 1999 all over again.

Its trading up because there was a high volume of naked shorts on the stock essentially locking in the short-sellers to HAVE to buy shares after a certain period, lest they pay ridiculous interest or worse. So when a bunch of extremely large, wealthy parties are required to buy back the shares, there is a HUGE volume of buys, and the price goes up. As long as people hold their shares, the price can just go up and up and up, and eventually the ones holding past-due naked-shorts have to essentially liquidate their own assets to pay back the shares they owe.

This has very little to do with Gamestop as a business. Gamestop just HAPPENED to be a meme, and people just HAPPENED to notice the HUGE percentage of short sellers on the stock.

![[H]ard|Forum](/styles/hardforum/xenforo/logo_dark.png)