DooKey

[H]F Junkie

- Joined

- Apr 25, 2001

- Messages

- 13,552

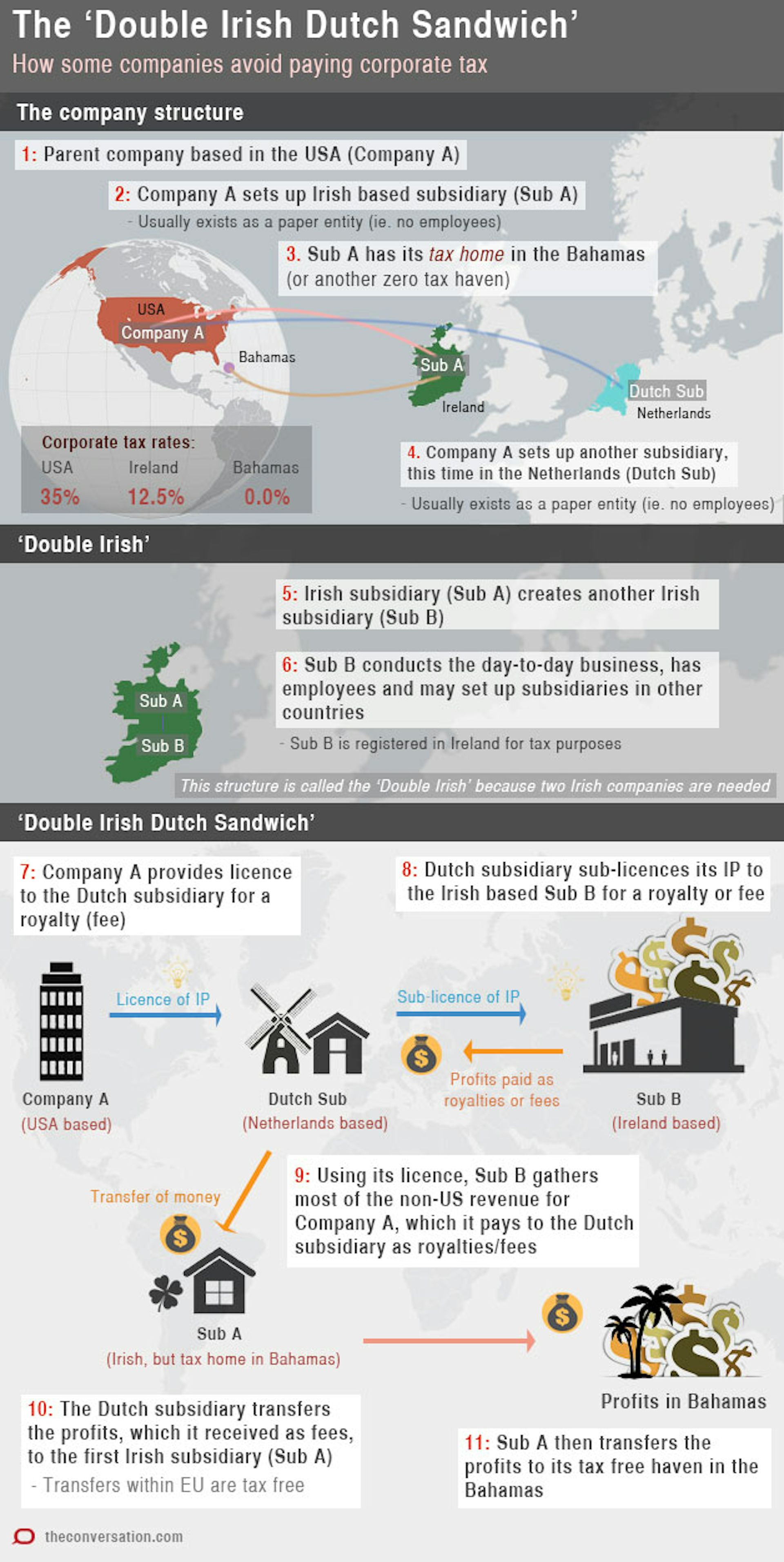

Google has shielded almost 16B euros in profits in 2016 by utilizing the 'Dutch Sandwich' tactic. Basically, they move their profits from an Irish subsidiary to a Dutch company without employees, and then to an Ireland-registered company with a Bermuda mailbox. This is a lot of money that's not taxed and the EU wants part of it, but after prevailing in court over a French effort to get 1.12B euros in taxes - I'd say that Google is going to get to keep this little tax haven for a few more years.

“We pay all of the taxes due and comply with the tax laws in every country we operate in around the world,” a Google spokesman said in a statement. “We remain committed to helping grow the online ecosystem.”

“We pay all of the taxes due and comply with the tax laws in every country we operate in around the world,” a Google spokesman said in a statement. “We remain committed to helping grow the online ecosystem.”

![[H]ard|Forum](/styles/hardforum/xenforo/logo_dark.png)