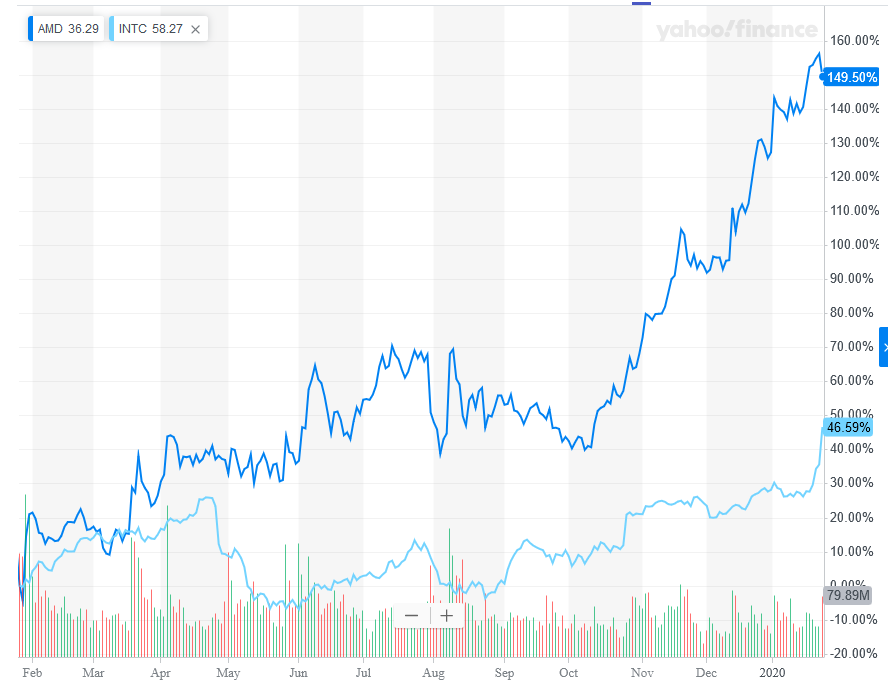

I assume most of you saw the news, but Intel's quarterly knocked it out of the park. And it looks like they are investing (again) a lot of money into trying to meet customers demands.

"Intel has managed to fend off rival Advanced Micro Devices, at least for now. Despite AMD launching competitive products across the desktop, laptop, and server chip markets, pressuring Intel on price, the chip giant was still able to impress investors with its fourth-quarter report."

...

"Intel plans to add additional wafer capacity in 2020 to meet growing demand for its PC chips. The company has been struggling to produce enough chips, and AMD's resurgence isn't helping matters. For 2020, Intel expects to produce revenue of $73.5 billion and non-GAAP (adjusted) EPS of $5.00, up 2.1% and 2.7%, respectively, from 2019."

https://www.fool.com/investing/2020/01/24/dow-jones-news-intel-soars-on-solid-earnings-apple.aspx

Adding Q4 report:

https://www.intc.com/investor-relat...eports-Fourth-Quarter-2019-Financial-Results/

"Intel has managed to fend off rival Advanced Micro Devices, at least for now. Despite AMD launching competitive products across the desktop, laptop, and server chip markets, pressuring Intel on price, the chip giant was still able to impress investors with its fourth-quarter report."

...

"Intel plans to add additional wafer capacity in 2020 to meet growing demand for its PC chips. The company has been struggling to produce enough chips, and AMD's resurgence isn't helping matters. For 2020, Intel expects to produce revenue of $73.5 billion and non-GAAP (adjusted) EPS of $5.00, up 2.1% and 2.7%, respectively, from 2019."

https://www.fool.com/investing/2020/01/24/dow-jones-news-intel-soars-on-solid-earnings-apple.aspx

Adding Q4 report:

https://www.intc.com/investor-relat...eports-Fourth-Quarter-2019-Financial-Results/

Last edited:

![[H]ard|Forum](/styles/hardforum/xenforo/logo_dark.png)