- Joined

- Aug 20, 2006

- Messages

- 13,000

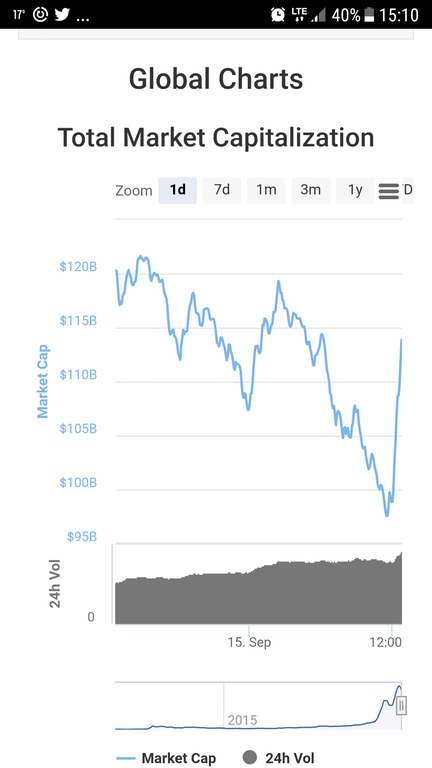

Bitcoin has seen its longest losing streak in more than a year after one of China’s largest online exchanges said it would stop handling trades by the end of the month amid a government crackdown on cryptocurrencies: China accounts for about 23 percent of bitcoin trades and is home to many of the world’s biggest bitcoin miners, but BTC has crashed as much as 35% in Chinese trading.

The communist nation plans to ban trading of bitcoin and other virtual currencies on domestic exchanges, Bloomberg News reported Monday. The ban will only apply to trading of cryptocurrencies on exchanges, according to people familiar with the matter, who asked not to be named because the information is private. Authorities don’t have plans to stop over-the-counter transactions, the people said. Shanghai Financial Service Office has also ordered to close down bitcoin trading platforms in the city, China Business News reported, citing an unidentified person.

The communist nation plans to ban trading of bitcoin and other virtual currencies on domestic exchanges, Bloomberg News reported Monday. The ban will only apply to trading of cryptocurrencies on exchanges, according to people familiar with the matter, who asked not to be named because the information is private. Authorities don’t have plans to stop over-the-counter transactions, the people said. Shanghai Financial Service Office has also ordered to close down bitcoin trading platforms in the city, China Business News reported, citing an unidentified person.

![[H]ard|Forum](/styles/hardforum/xenforo/logo_dark.png)