FlawleZ

[H]ard|Gawd

- Joined

- Oct 20, 2010

- Messages

- 1,691

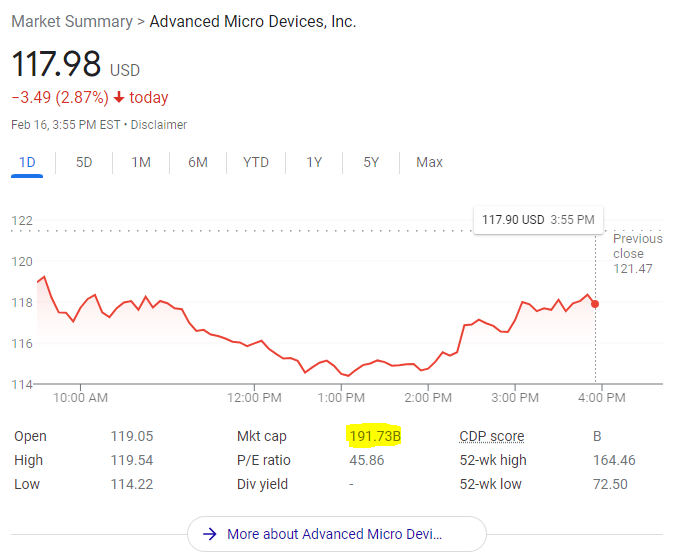

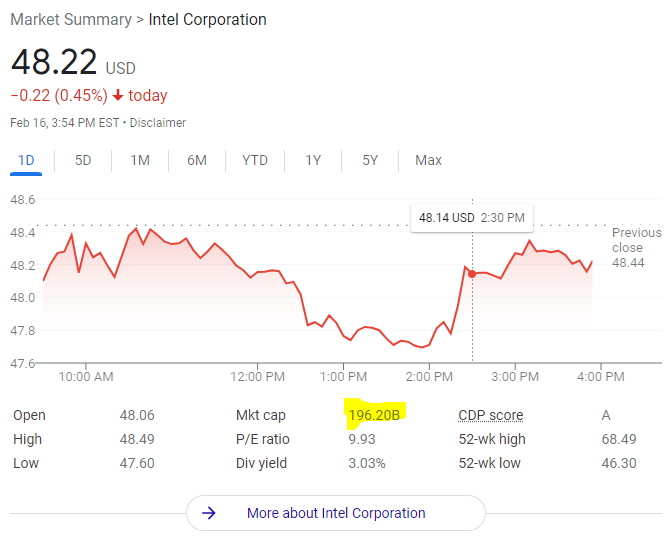

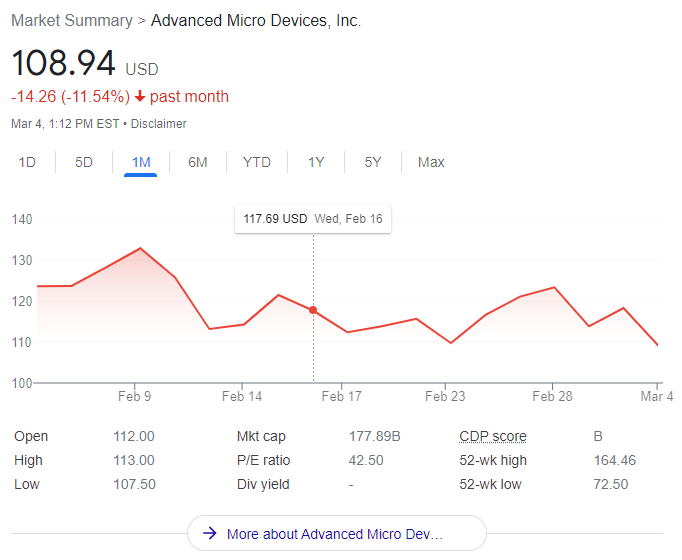

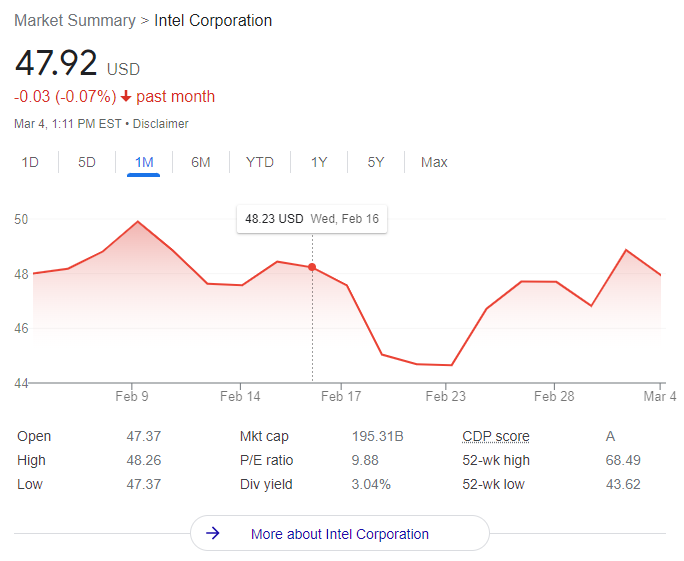

https://www.tomshardware.com/news/amds-market-cap-surpasses-intelAMD is now a bigger company, by market capitalization, than Intel. It may be close, but AMD has passed Intel for the first time in the company's history with a ~$197.75 billion market cap at the close of the market on February 15 compared to Intel's $197.24 billion. AMD's sudden market cap surge comes on the back of its blockbuster $49 billion acquisition of Xilinx, the largest semiconductor acquisition in history.

AMD's acquisition of Xilinx triggered the conversion of 248.38 million Xilinx shares into 428 million new AMD shares (a process that is ongoing). Added to AMD's existing 1.2 billion shares, that brings the company's overall share count to 1.628 million, giving AMD a market cap of $197.75 billion that squeaks past Intel by a mere $51 million. (There might be some variance in calculations from the various third parties, but all should place AMD in the lead over Intel at current stock valuations.)

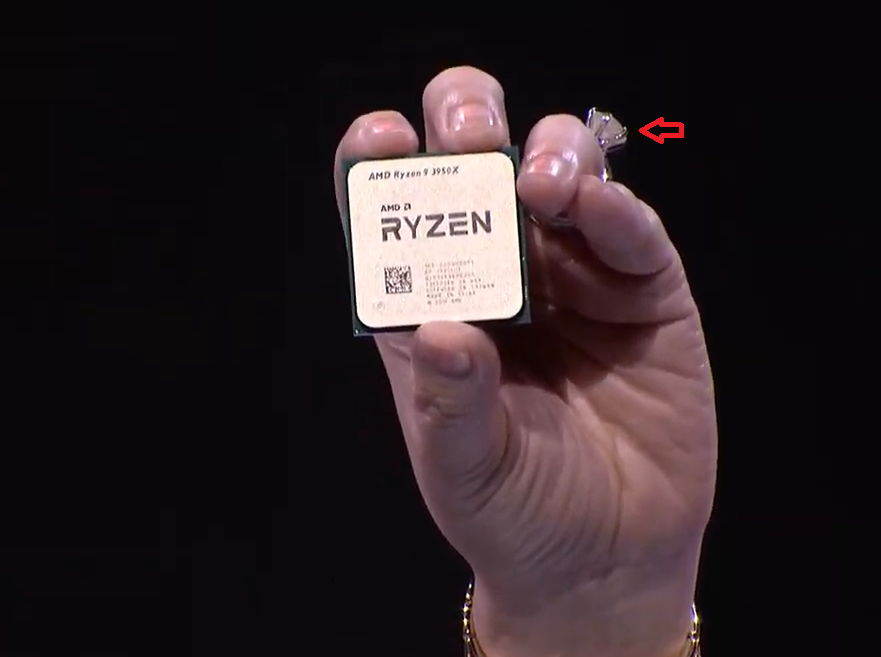

That marks a stark reversal for a company that was teetering on the brink of bankruptcy a mere six years ago when it first unveiled its revolutionary Zen CPU microarchitecture. Six years of relentless execution later, AMD now has an all-time high share of the CPU market, giving it the cash to ink the biggest semiconductor deal in history.

My how the times have changed...

![[H]ard|Forum](/styles/hardforum/xenforo/logo_dark.png)