erek

[H]F Junkie

- Joined

- Dec 19, 2005

- Messages

- 10,894

Busted! Bad operations!!

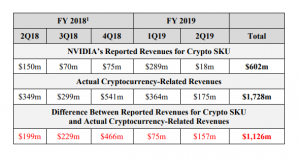

"Former employees from China and Russia are crucial in assessing whether NVIDIA did really mislead investors due to the fact that cryptocurrency mining operations were generally located in these countries due to low energy costs.

Mining Ethereum using GPUs.

The complainants allege that NVIDIA's management misled investors in the entire affair primarily"

https://regmedia.co.uk/2020/05/15/nvidiashareholdersuit.pdf

"Former employees from China and Russia are crucial in assessing whether NVIDIA did really mislead investors due to the fact that cryptocurrency mining operations were generally located in these countries due to low energy costs.

Mining Ethereum using GPUs.

The complainants allege that NVIDIA's management misled investors in the entire affair primarily"

https://regmedia.co.uk/2020/05/15/nvidiashareholdersuit.pdf

![[H]ard|Forum](/styles/hardforum/xenforo/logo_dark.png)