- Joined

- May 18, 1997

- Messages

- 55,601

We should on the 2nd from what has been communicated to me.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

I don't see this price on Amazon being the actual MSRP when they start shipping in volume. It's likely just a guesstimate placeholder from Amazon until they're released on July 9th. I can see these being like $20-30 more than the current 2060/2070 and the current ones dropping down by $50ish. I'll continue to wait on the 7nm refresh from NVIDIA. Like others have said, my Titan X (Pascal) from 2016 is still going strong and slaying everything at 1440p so I've got no need to upgrade yet--it was an expensive purchase initially but has paid off in spades since I've never held on to a graphics card as long as this.

LOL the trend is NV has wanted you to keep paying more and more, so this was expected. I never bought that $100 less than non-super variants rumor. Anyone remember "the good old days" when a 1070ti only set you back $450? Super = renamed Ti in my opinion.Holy shit 600?

I thought it was going to be lower.

AMD should aggressively price war...

I don't see this price on Amazon being the actual MSRP when they start shipping in volume. It's likely just a guesstimate placeholder from Amazon until they're released on July 9th. I can see these being like $20-30 more than the current 2060/2070 and the current ones dropping down by $50ish. I'll continue to wait on the 7nm refresh from NVIDIA. Like others have said, my Titan X (Pascal) from 2016 is still going strong and slaying everything at 1440p so I've got no need to upgrade yet--it was an expensive purchase initially but has paid off in spades since I've never held on to a graphics card as long as this.

Wrong. They have been killing it on their financials.It boggles my mind that Nvidia didn't learn their lessons on why the first

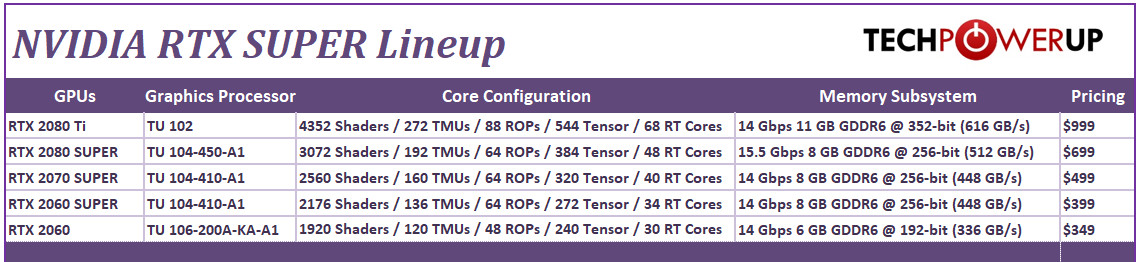

Looks like TPU got the scoop on pricing:

Looks like TPU got the scoop on pricing:

View attachment 170849

So not TOO bad but not great either. Still a hard pass from me until 7nm.

No way the Ti is going to cost just $999, that is not going to happen, in my opinion.

Next up: You are no longer able to buy Nvidia RTX 3xxx cards unless you know Scientific Notation, as the price is expressed in Scientific Notation.

... Also, triple slot 2060? LOL!

The starting MSRP on the Ti has been $999 since it launched...I think they got the scoop on fantasy pricing, anyways. No way the Ti is going to cost just $999, that is not going to happen, in my opinion.

The starting MSRP on the Ti has been $999 since it launched...

FE cards were $1200....I could have sworn it was $1199 at launch.

Ah, Right.FE cards were $1200....

I could have sworn it was $1199 at launch.

Wrong. They have been killing it on their financials.

So... finally 2 years later... we can get the same performance for $699. Exciting!Looks like TPU got the scoop on pricing:

View attachment 170849

So not TOO bad but not great either. Still a hard pass from me until 7nm.

Different versions and launch scarcity, but yeah, the absolute base price was and is US$999.

Glad you posted that. Don't know how anyone could say NVDA is killing it. Consolidated income and quarterly earnings growth are down near 70% from year ago. Furthermore, Nvidia's gaming revenue dropped by near half in same time period. All the while Nvidia's R&D costs have been rising. No doubt much to do with their inevitable shift toward driver-less auto tech. Revenues from which rose over 25% last year. We must face fact that PC gaming is an ever shrinking percentage of the market. Precious little new blood coming in. Bloated prices during the mining boom certainly did not help matters.Yeah, they’re absolutely killing it. Q1 revenue down nearly $1 billion year over year, and sequential quarterly growth was a measly $10 million.

https://nvidianews.nvidia.com/news/nvidia-announces-financial-results-for-first-quarter-fiscal-2020

While they might have beat Wall Street estimates, revenue is still 31% down year-over-year and their stock price is down 45% from its high last year. Even more to the point, their gaming segment was down a whopping 39%:

https://www.cnbc.com/2019/05/16/nvidia-earnings-q1-2020.html

Jensen stating the Q2 outlook is lower than original estimates. That doesn’t look like they’re “killing it” to me. But, let’s talk about their RTX cards:

https://marketrealist.com/2019/06/whats-pressuring-nvidias-gaming-business/

Oops, losing market share to AMD:

https://marketrealist.com/2019/06/nvidia-loses-some-discrete-gpu-market-share-to-amd/

Even Jensen said “Nvidia is back on an upward trajectory” in the first link, implying things haven’t been going as planned. Of course, my initial point was that RTX sales haven’t met expectations and nVidia has apparently decided to double down on their stupidity, and these articles support that claim.

Glad you posted that. Don't know how anyone could say NVDA is killing it. Consolidated income and quarterly earnings growth are down near 70% from year ago. Furthermore, Nvidia's gaming revenue dropped by near half in same time period. All the while Nvidia's R&D costs have been rising. No doubt much to do with their inevitable shift toward driver-less auto tech. Revenues from which rose over 25% last year. We must face fact that PC gaming is an ever shrinking percentage of the market. Precious little new blood coming in. Bloated prices during the mining boom certainly did not help matters.

Of course, my initial point was that RTX sales haven’t met expectations and nVidia has apparently decided to double down on their stupidity, and these articles support that claim.

only loser in a price war would be AMD. I can guarantee that. AMD would rather sell less at higher margin then sell more at much lower margin. On top if AMD lowered prices too much then Nvidia would likely have to react and no one buys amd again lol. I think stuff will return to sanity once you see RDNA 2 high end cards and amd can drive prices down and still have high margins.Holy shit 600?

I thought it was going to be lower.

AMD should aggressively price war...

Stating numbers is not axe grinding. Sure some perspective helps. Let's apply that equally. Interesting the article, and many similar ones, make no mention of the CFO's statement about poor revenues in regards to the underwhelming Turing launch. But hey ... they're tech sites.This has really become favorite misleading use of data, for everyone with some kind of NVidia axe to grind. NVidia revenues were inflated a large amount by the crypto-mining madness. This "big loss" is just things returning to normal. Or in the words of Anandtech:

NVIDIA Q1 FY 2020 Earnings Report: Post-Crypto Reset

"Although seeing such a drop is never good, some perspective is required. NVIDIA’s 2019 fiscal year was a standout. Revenue in Q1 2019 was $3.2 billion, with a net income of $1.2 billion. But if you go back to Q1 2018, revenue was $1.9 billion, and net income was $507 million, which is much closer to Q1 2020. Comparing Q1 2018 to Q1 2020 has 2020 up 14.6% on revenue, and net income down 28.6%. Clearly the inflated results thanks to a perfect storm for NVIDIA’s 2019 financials has ended though, and the company has been thrust back to reality. Luckily reality for the company is that a Q1 of $2.2 billion makes it easily their second best Q1 ever, so I think they’ll be OK."

Wrong. They have been killing it on their financials.

Stating numbers is not axe grinding. Sure some perspective helps. Let's apply that equally. Interesting the article, and many similar ones, make no mention of the CFO's statement about poor revenues in regards to the underwhelming Turing launch. But hey ... they're tech sites.

Wrong. They have been killing it on their financials.

Nvidia's financials compared to other years that weren't in the mining boom are very good for q1 historically. That's what I meant.

And unfortunately none of your links to articles about Nvidia's stock prices and business overall directly supports the narrative that RTX CaRdZ ArE ToO ExPensiVe.

Seriously, that's the kid logic. "If RTX cards were cheaper then their stock price would be bettur"

Is an RTX 2060 even a genuinely large performance improvement over an overclocked GTX 980Ti, ignoring power consumption? 1660Ti? Am I correct that it will cost me $300~ just to match or barely exceed my existing Maxwell cards?

I'm not biting on anything because I'm willing to bet the lower end cards (2060-2070) will drop massively in value by next year. I don't give a damn what is provably too expensive. It's too expensive for me and I like to think about the return value on my card if I sell it in 2-3 years relative to what I pay.

The 980Ti = 1070 = 1660Ti.

The standard 'nonsuper' 2060 = 1070ti level (which is about 5% away from a 1080), and is an upgrade from your 980Ti, but probably not enough to shell out 300-400$ for it.

Might end up waiting another year I guess..

Hmm yeah sounds about right, my 980Ti at ~1440mhz matches my buddies Black edition EVGA 1070Ti (no OC), so that's what I was thinking -- maybe 15-20% more frames on an overclocked 2060. I'd like to see the kind of boost I got going from a 280x to a 980Ti again, which I think would be 1080Ti/2080 at this point. I don't know if the 5700XT will make me happy.

Might end up waiting another year I guess..

I'd love to see a poll or story on how many people are still holding onto their 980Ti's. One of the best gens imho.

Recommend waiting unless that 15%-20% is what you need to 'get there', wherever there is, especially if what you have is working for you right now.