_mockingbird

Gawd

- Joined

- Feb 20, 2017

- Messages

- 992

GlobalFoundries on Monday announced an important strategy shift. The contract maker of semiconductors decided to cease development of bleeding edge manufacturing technologies and stop all work on its 7LP (7 nm) fabrication processes, which will not be used for any client. Instead, the company will focus on specialized process technologies for clients in emerging high-growth markets. These technologies will initially be based on the company’s 14LPP/12LP platform and will include RF, embedded memory, and low power features. Because of the strategy shift, GF will cut 5% of its staff as well as renegotiate its WSA and IP-related deals with AMD and IBM. In a bid to understand more what is going on, we sat down with Gary Patton, CTO of GlobalFoundries.

7LP Canned Due to Strategy Shift

GlobalFoundries was on track to tape out its clients’ first chips made using its 7 nm process technology in the fourth quarter of this year, but “a few weeks ago” the company decided to take a drastic strategical turn, says Gary Patton. The CTO stressed that the decision was made not based on technical issues that the company faced, but on a careful consideration of business opportunities the company had with its 7LP platform as well as financial concerns.

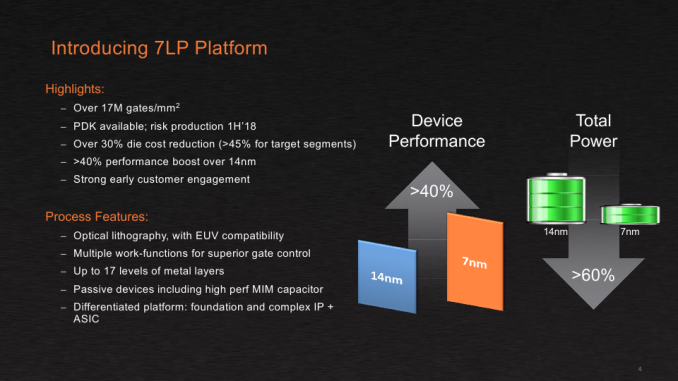

It is noteworthy that when GlobalFoundries first announced its 7LP platform in September 2016, it said that it would start risk production of processors using this technology in early 2018 (PR), which means that the first chips should have been taped out before that. When the company detailed the process in June 2018, it said that it expected to start “volume production ramping in the second half of 2018” (PR), which would be close to impossible if customers taped out their first chips only in Q4.

Generally, it looks like the company had to adjust its roadmap somewhere along the way, moving the start of high-volume manufacturing (HVM) further into 2019. Whether or not these adjustments had any implications on GlobalFoundries is up to debate. Keep in mind that AMD’s first 7 nm product was designed for TSMC’s CLN7FF from the beginning, so the company did not bet on GF’s 7LP in late 2018 anyway, and no rush with the manufacturing technology was needed for GF’s key customer.

Along with the cancellation of the 7LP, GlobalFoundries essentially canned all pathfinding and research operations for 5 nm and 3 nm nodes. The company will continue to work with the IBM Research Alliance (in Albany, NY) until the end of this year, but GlobalFoundries is not sure it makes sense to invest in R&D for ‘bleeding edge’ nodes given that it does not plan to use them any time soon. The manufacturer will continue to cooperate with IMEC, which works on a broader set of technologies that will be useful for GF’s upcoming specialized fabrication processes, but obviously it will refocus its priorities there as well (more on GF’s future process technologies later in this article).

So, the key takeaway here is that while the 7LP platform was a bit behind TSMC’s CLN7FF when it comes to HVM – and GlobalFoundries has never been first to market with leading edge bulk manufacturing technologies anyway – there were no issues with the fabrication process itself. Rather there were deeper economic reasons behind the decision.

Economic Reasons Behind the Move

As we noted in our article covering GlobalFoundries's new CEO hire earlier this year, one of the things that the former chief exec Sanjay Jha failed to do was to make the company profitable. His key tasks were to increase GlobalFoundries’s sales, streamline the company in general, and ensure that it executes its roadmap.

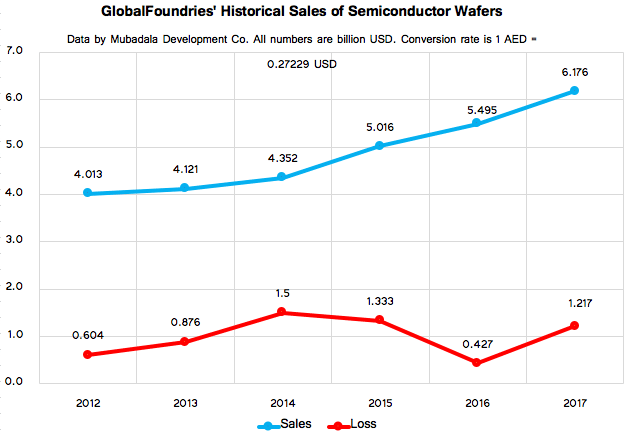

To address the needs of the manufacturer’s traditional key client (AMD) and ensure that his company was competitive against other contract makers of semiconductors, he licensed the 14LPP fabrication technology from Samsung Foundry. That strategy worked well. With Sunjay Jha at the helm, GlobalFoundries has managed to land a variety of new customers and increase its sales of semiconductor wafers from approximately $4.121 billion in 2013 to $6.176 billion in 2017. Besides, the foundry’s leading-edge Fab 8, which has been processing wafers using exclusively 14LPP process technology for well over 1.5 years now, is running at full capacity.

To ensure that GlobalFoundries remains competitive against Samsung Foundry and TSMC in the long run, Sunjay Jha obtained IP and development teams from IBM (along with two fabs and a lot of obligations), and poured in billions of dollars in development of the 7LP fabrication technology platform. The latter would include three generations of manufacturing processes and, possibly, a custom high-performance technology available exclusively to IBM. While everything appeared to proceed smoothly with the 1st Gen 7 nm (DUV only), the 2nd Gen 7 nm (with EUV used for non-critical layers, such as padding) still needed some additional development investments, whereas the 3rd Gen 7 nm (with intensive usage of EUV) required even more money for development and could require installation of additional EUV equipment. Meanwhile, there were two things to consider.

First. If GlobalFoundries kicks off production using the 1st Gen 7 nm fabrication process, it would have needed to cure all of its teething troubles and offer its clients a roadmap forward. The latter would have included 2nd Gen and 3rd Gen 7 nm, but nothing stops there. Customers would have asked for 5 nm and then for 3 nm nodes. Meanwhile, you cannot tell your clients that you are packing after a certain node and then hope that this node will be a success (the same is true for DUV-only 1st Gen 7 nm).

Second. Development of leading-edge process technologies is extremely expensive. Every new node requires billions of dollars of investments. The latter are eventually transferred to each chip the company makes, so to maintain the R&D cost of each chip at a reasonable level, foundries need to produce more chips. To make more chips, they need to either run multiple fabs that use the same process technology (these are going to cost $10+ billion in the EUV era), or build giant fabs that process a gargantuan number of wafers (these are going to cost $20+ billion in the EUV era). Meanwhile, GlobalFoundries has only one leading-edge fab featuring capacity of 60,000 wafer starts per month. As a result, either GlobalFoundries has to increase the R&D ingredient in the cost of each wafer it processes and become uncompetitive against rivals, or retain it at a current level and decrease its ROI (return on investment).

Meanwhile, having spent well over $20 billion on GlobalFoundries over the last 10 years, Mubadala, the owner of the company, is not inclined to lose more money or invest tens of billions hoping to become profitable one day. The investor wants GlobalFoundries to stop bleeding and start generating profits.

“The culture of [our investments], the ones I’ve been involved with, was about accumulating assets and then just maintaining it,” said Khaldoon Al Mubarak, CEO of GlobalFoundries, said in an interview with Bloombergearlier this year. “The shift that has happened over the last couple of years, that I’ve tried to push at Mubadala today, is a monetization strategy that makes sense, not with a view to cash out but with a view to reinvest.”

Gary Patton admits that GlobalFoundries never planned to be a leading producer of 7-nm chips in terms of volumes. Furthermore, the company has been seeing increasing adoption of its 14LPP/12LP technologies by designers of various emerging devices, which fills the Fab 8 in, leaving less step-and-scan systems for 7LP products.

Without another big fab, it would be impossible to make any new leading-edge process technology competitive against Samsung and TSMC due to aforementioned reasons. Meanwhile, building a new fab (or even expanding the Fab 8 with another cleanroom module, which is something that GF considered several years ago) and creating another node or two would require another $10 – $15 billion from Mubadala, which is not inclined to invest just now. As a result, the GlobalFoundries decided to switch entirely to specialized process technologies for emerging high-growth markets. This strategic shift enables it to reduce spending on R&D, slowdown procurement of new equipment, reduce its workforce by 5% (most of which will be in Malta), and potentially avoid direct competition against the aforementioned contract makers of semiconductors. But what exactly does GlobalFoundries plan to do? Let’s find out in our next sections.

Source: https://www.anandtech.com/show/13277/globalfoundries-stops-all-7nm-development

![[H]ard|Forum](/styles/hardforum/xenforo/logo_dark.png)