cageymaru

Fully [H]

- Joined

- Apr 10, 2003

- Messages

- 22,080

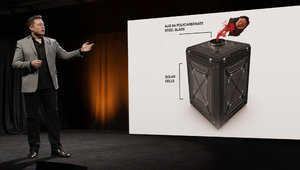

Elon Musk has revealed that a great deal of the funding to take Tesla private will come from the Saudi Arabia sovereign wealth fund. He backed up his August 7th claim that the funding was secured by revealing that the Managing Director of the fund had contacted him multiple times over the course of the past two years seeking to take Tesla private. As previously reported, Elon Musk is not happy with the pressure that short sellers place upon the company's stock.

It is also worth clarifying that most of the capital required for going private would be funded by equity rather than debt, meaning that this would not be like a standard leveraged buyout structure commonly used when companies are taken private. I do not think it would be wise to burden Tesla with significantly increased debt. Therefore, reports that more than $70B would be needed to take Tesla private dramatically overstate the actual capital raise needed. The $420 buyout price would only be used for Tesla shareholders who do not remain with our company if it is private. My best estimate right now is that approximately two-thirds of shares owned by all current investors would roll over into a private Tesla.

It is also worth clarifying that most of the capital required for going private would be funded by equity rather than debt, meaning that this would not be like a standard leveraged buyout structure commonly used when companies are taken private. I do not think it would be wise to burden Tesla with significantly increased debt. Therefore, reports that more than $70B would be needed to take Tesla private dramatically overstate the actual capital raise needed. The $420 buyout price would only be used for Tesla shareholders who do not remain with our company if it is private. My best estimate right now is that approximately two-thirds of shares owned by all current investors would roll over into a private Tesla.

![[H]ard|Forum](/styles/hardforum/xenforo/logo_dark.png)