CommanderFrank

Cat Can't Scratch It

- Joined

- May 9, 2000

- Messages

- 75,399

Let’s say that you owe back taxes to the IRS for the past 15-20 years and the government offers you a repayment plan at a huge reduction and no penalty. You would jump on the deal like a duck on a Junebug.  That is basically what a proposed bill would do for major corporations that presently have all of their cash stockpiled outside of the US.

That is basically what a proposed bill would do for major corporations that presently have all of their cash stockpiled outside of the US.

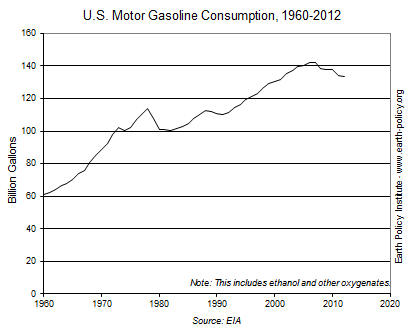

The Boxer-Paul plan stems from Congress' opposition to raising the gas tax, which has traditionally gone towards the Highway Trust Fund.

![[H]ard|Forum](/styles/hardforum/xenforo/logo_dark.png)